Understanding the Nikkei Index and Its Global Impact

Introduction

The Nikkei Index, Japan’s primary stock market index, is a crucial metric for investors and economists worldwide. Comprising 225 major companies listed on the Tokyo Stock Exchange, the Nikkei serves as a barometer for the performance of the Japanese economy and, by extension, influences global market trends. Understanding the dynamics of the Nikkei Index is essential for investors who wish to gauge economic confidence, market sentiment, and investment opportunities not just in Japan, but across Asia and beyond.

Current Trends and Developments

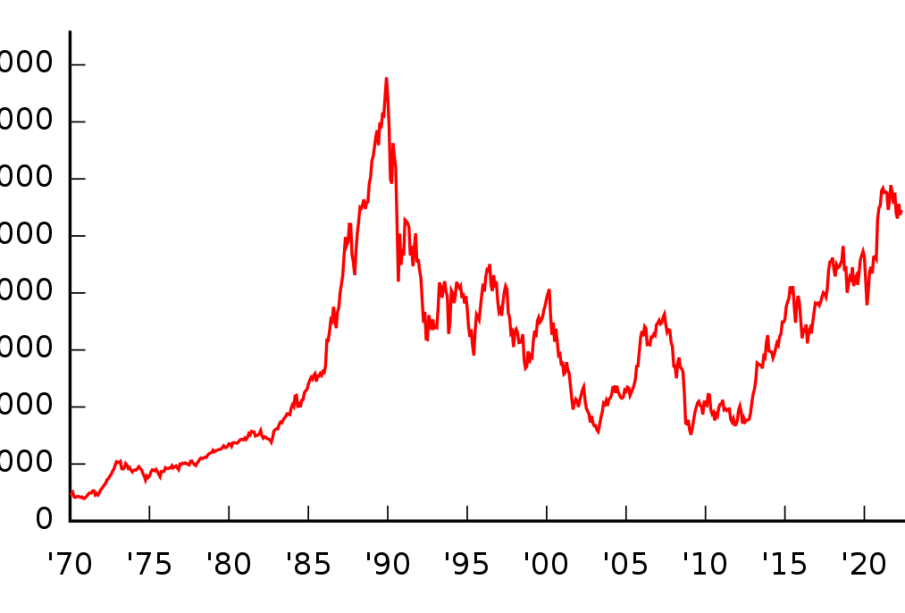

As of October 2023, the Nikkei Index has shown considerable resilience in light of ongoing global economic challenges. Recently, it has been trading above 30,000 points, a level not seen since the economic bubble of the late 1980s. This upward trend can be attributed to various factors, including robust corporate earnings, a weaker yen which favors exporters, and positive shifts in domestic policy aimed at stimulating growth.

Particularly noteworthy was the recent announcement from the Bank of Japan regarding its stance on interest rates. As the country continues to combat inflation while attempting to boost consumer spending, the dovish tone from the central bank has provided stimulus to the stock market, further propelling the Nikkei upwards. The market has also reacted positively to the fiscal policies encouraging foreign investment in Japan, opening avenues for long-term growth.

Impact on Global Markets

The performance of the Nikkei Index is not just an indicator of Japan’s economic health, but it also has significant implications for global markets. Historically, fluctuations in the Nikkei have been mirrored in other Asian markets, particularly those in South Korea and China, due to their interconnected economies. Investors monitor the Nikkei closely; a strong performance can lead to increased confidence in Asian equities, while a downturn might raise concerns about global trade and economic stability.

Conclusion

In conclusion, the Nikkei Index remains a vital indicator of economic health, directly influencing Japan’s financial landscape and offering insights into broader market trends. Looking ahead, analysts are cautious yet optimistic, noting that while the index’s current performance is encouraging, external factors such as geopolitical tensions and changes in global trade policies will continue to play a crucial role. For investors and stakeholders, keeping an eye on the Nikkei is essential for making informed decisions in the ever-evolving global market landscape.