Understanding the Nikkei 225: Japan’s Leading Stock Index

Introduction

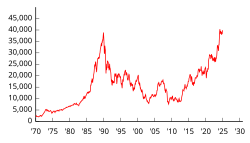

The Nikkei 225, a stock market index for the Tokyo Stock Exchange (TSE), is a critical measure of Japan’s economic health. Tracking the performance of 225 large, publicly owned companies in Japan, the index provides insights into market trends and investor sentiment. As one of the oldest and most recognized indices in Asia, fluctuations in the Nikkei 225 often reflect broader economic changes and have implications for global investors.

Recent Trends and Developments

As of October 2023, the Nikkei 225 has shown a resilient performance amid global economic uncertainties, including inflationary pressures and geopolitical tensions. Recent reports indicate the index has gained approximately 15% year-to-date, buoyed by strong corporate earnings and a relatively stable yen. Investors have observed a notable uptick in technology and export-driven sectors, as demand continues to recover post-pandemic.

Economists attribute this growth to several factors, including the Bank of Japan’s ongoing loose monetary policy, which aims to stimulate the economy by ensuring liquidity and keeping interest rates low. In September, the BoJ indicated it would maintain its accommodative stance, despite global central banks tightening their monetary policies. This decision has significantly contributed to investor confidence, boosting the Nikkei 225.

Market Effects and Global Implications

The Nikkei 225 is not only a barometer of Japan’s economic health but also a benchmark for global market behavior. As international investors keep a close eye on the Japanese market, movements in the Nikkei can influence trading patterns in other Asian economies and even farther afield. For instance, a significant uptick in the Nikkei often sparks movement in tech stocks globally, as Japan is home to major players in technology and automobiles like Sony and Toyota.

Moreover, analysts point out that the Nikkei’s performance leads to shifts in investor strategies, particularly in emerging markets. A strong Nikkei typically signals confidence in Japan’s economic recovery, prompting investors to seek similar growth stories in other Asian markets.

Conclusion

The Nikkei 225 remains a crucial financial indicator, reflecting Japan’s economic landscape while influencing global markets. As Japan continues to navigate post-pandemic recovery amidst evolving economic conditions, the index’s performance will be closely watched by investors and policymakers alike. Looking forward, while challenges persist, the outlook for the Nikkei appears optimistic, potentially providing investment opportunities for those keen on harnessing Japan’s economic resurgence.