Understanding the Nikkei 225 Index and Its Market Significance

Introduction

The Nikkei 225 is a stock market index that represents the performance of 225 large publicly owned companies in Japan. As one of the leading equity indices in Asia, it is a significant indicator of the health of the Japanese economy and, by extension, the global market. Understanding the trends and movements of the Nikkei 225 can provide investors and analysts with insights into economic stability and growth potential in the region.

Current Trends in the Nikkei 225

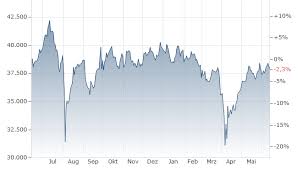

As of October 2023, the Nikkei 225 has shown a remarkable recovery following the challenges posed by the global pandemic and subsequent economic disruptions. Currently, the index is fluctuating around the 30,000 mark, bolstered by strong corporate earnings reports and governmental economic stimulus plans aimed at supporting growth. This upward trend reflects improved investor confidence in Japan’s leading sectors, such as technology, manufacturing, and export-oriented businesses.

In recent weeks, the index saw a notable spike of approximately 4% after the Bank of Japan announced its decision to maintain its ultra-loose monetary policy, reassuring investors about continuing support for the economy. Analysts anticipate that this approach will remain in place amid ongoing challenges like global supply chain issues and geopolitical tensions.

Economic Indicators and Their Influence

Several factors have been attributed to the Nikkei 225’s current performance. Key among them is Japan’s recent GDP growth, which exceeded expectations, as the economy rebounded strongly in the second half of 2023. Consumer spending and investments have bolstered this growth, leading to positive corporate earnings that have encouraged investment in Japanese stocks.

Moreover, recent trade agreements across Asia and with Western nations have paved the way for increased exports from Japan, providing another boost to the Nikkei 225. The tech sector, in particular, has shown resilience, with companies like Sony and Toyota reporting strong quarterly performance that has positively influenced the index.

Conclusion

In summary, the Nikkei 225 remains an important barometer for not only Japan’s economic health but also for assessing investor sentiment in Asia. Observers will need to keep an eye on factors like monetary policy, corporate earnings, and international trade developments to gauge future movements in the index. Given its recent performance, analysts project that while the Nikkei 225 may continue to face volatility due to external pressures, it is likely to maintain a bullish outlook in the coming months as Japan gradually stabilizes and grows economically.