Understanding the Mudra Loan and Its Impact on Small Businesses

Introduction

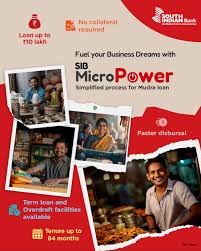

Mudra Loan has emerged as a pivotal initiative by the Government of India aimed at fostering small enterprises and enhancing entrepreneurship across the country. Launched in 2015 under the Pradhan Mantri Mudra Yojana (PMMY), this scheme offers financial support to micro and small businesses, facilitating their growth and development. With the Indian economy increasingly leaning on small businesses for job creation and innovation, the significance of Mudra Loans cannot be overstated.

The Mudra Loan Scheme Explained

The PMMY categorizes Mudra Loans into three distinct types, tailored to suit various business needs:

- Shishu: Loans up to ₹50,000 for start-ups and small businesses in their initial phase.

- Kishore: Loans from ₹50,000 to ₹5 lakh for established small businesses looking to expand.

- Tarun: Loans from ₹5 lakh to ₹10 lakh for more mature businesses aiming for significant expansion.

This tiered loan structure helps entrepreneurs access required funds based on their business stages and requirements.

Recent Developments and Trends

As of 2023, the Mudra Loan initiative has disbursed over ₹3 lakh crore to more than 37 crore beneficiaries, indicating the scheme’s widespread impact and popularity. Recent data from the Ministry of Finance reveals an increasing trend in the number of loans being sanctioned, especially in rural and semi-urban areas. This is significant as it reflects the government’s commitment to financial inclusion and empowerment of the underserved sections of society.

In addition to financial support, the Mudra scheme also offers a variety of support services such as financial literacy programs and mentorship, which are critical for the sustainable growth of small businesses.

Challenges and Concerns

Despite its success, there are challenges associated with the Mudra Loan program. Many beneficiaries report difficulties in meeting repayment schedules due to fluctuating market conditions and lack of business acumen. Furthermore, there have been concerns about the rate of default among borrowers, prompting the need for more rigorous financial education and support.

Conclusion

The Mudra Loan scheme represents a significant step towards empowering small businesses in India, necessary for economic growth and employment generation. As the government continues to support this initiative, it is crucial for entrepreneurs to leverage the available resources effectively while also focusing on loan repayment to ensure the sustainability of their ventures. Looking ahead, enhancing financial literacy and providing ongoing support to borrowers will be essential in overcoming existing challenges and maximizing the potential of Mudra Loans.