Understanding the Latest Trends in Mazdock Share Price

Introduction

The share price of Mazdock, a prominent player in the shipbuilding industry in India, has garnered significant attention in recent weeks due to its performance on the stock market. Understanding the fluctuations in Mazdock’s share price can provide insights into the company’s operational efficiencies, market conditions, and investor sentiment. With increasing global demand for maritime infrastructure and a push for indigenous manufacturing, tracking Mazdock’s shares is crucial for investors and industry analysts alike.

Recent Trends in Mazdock Share Price

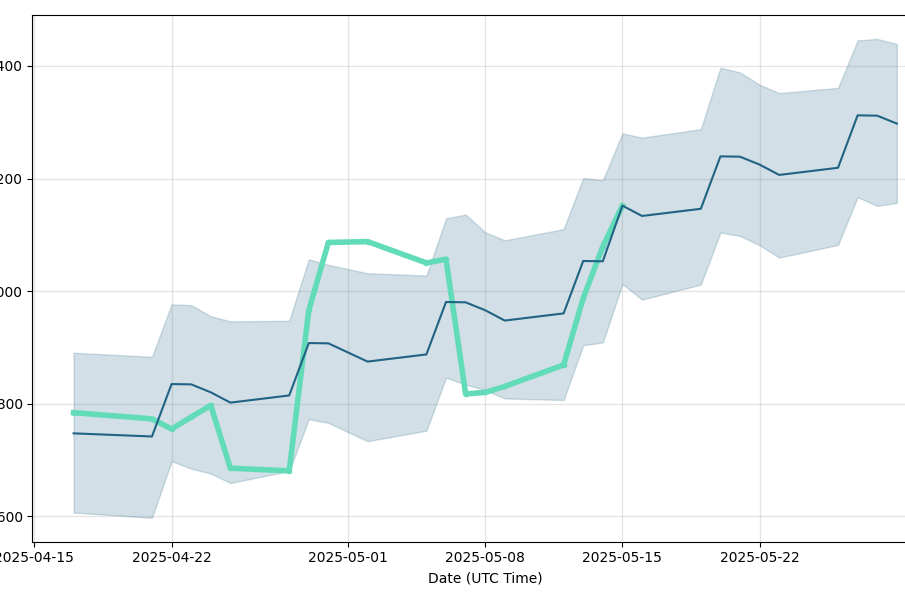

As of the end of October 2023, Mazdock’s share price has been on a volatile yet upward trajectory. Recent data reveals that within the past month, the stock has seen an appreciation of approximately 15%. Analysts attribute this growth to multiple factors including robust quarterly earnings, government initiatives promoting the Make in India campaign, and increased orders for naval ships.

In its latest quarterly report, Mazdock posted a revenue increase of 20% year-over-year, leading to enhanced investor confidence. This surge is reflected in its current share price of around INR 325, a noticeable increase from its September figures. The company has also announced new projects under its belt, further signifying its expanding market role.

Market Reactions

Investor sentiment surrounding Mazdock is buoyed by the Indian government’s focus on naval expansion and defense readiness. Additionally, the company’s proactive engagement in enhancing operational capabilities and opting for sustainable practices has attracted interest from socially responsible investors. Experts predict that if the current government policies remain favorable and Mazdock effectively executes its project timelines, the share prices could continue to ascend.

Conclusion

In conclusion, the recent behaviors observed in Mazdock’s share price underscore the dynamic nature of the maritime industry in India. With government backing and a strong financial report, investors might find Mazdock a worthwhile consideration in their portfolio. Looking ahead, analysts remain optimistic that continued growth in demand for naval and commercial vessels will bolster Mazdock’s presence, making it a key stock to watch in the upcoming quarters. Investors are encouraged to conduct thorough analysis and consider market conditions before making investment decisions.