Understanding the Latest FOMC Minutes and Their Impact

Introduction

The Federal Open Market Committee (FOMC) minutes hold significant importance for economists, investors, and policymakers, as they provide insights into the Central Bank’s decisions regarding interest rates and monetary policy. Recent FOMC minutes released in September 2023 have drawn attention, reflecting the Federal Reserve’s ongoing response to inflation and economic growth concerns.

Details from the Latest FOMC Minutes

In the September meeting, the FOMC decided to maintain the federal funds rate within the range of 5.25% to 5.50%. The minutes highlighted that inflation, although slightly lower, remains above the Fed’s 2% target. The committee members expressed varied opinions on future rate hikes, with some advocating for caution while others supported further tightening to combat inflationary pressures. Additionally, discussions regarding labor market dynamics revealed that the job market remains robust, contributing to current inflation rates.

The minutes also emphasized the challenges posed by global economic uncertainties, including geopolitical tensions and the impacts of supply chain disruptions. Economists noted that these factors could influence consumer spending and overall economic growth.

Impact on Financial Markets

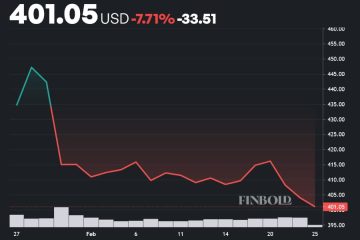

The release of the FOMC minutes often leads to volatility in financial markets, as traders react to hints of the Fed’s future policy direction. Following the latest minutes, stock indices experienced fluctuations, while bond yields saw adjustments reflecting the anticipation of future interest rate movements.

Conclusion and Future Outlook

The insights from the latest FOMC minutes suggest a cautious yet proactive approach by the Fed. As the economic landscape evolves, the committee’s decisions will likely continue to depend on the interplay between inflation, employment, and global economic conditions. Investors and stakeholders should stay informed, as the potential for future interest rate changes could significantly impact investment strategies and economic growth. In summary, the FOMC minutes are crucial for understanding the Fed’s monetary policy trajectory and its implications for the broader economy.