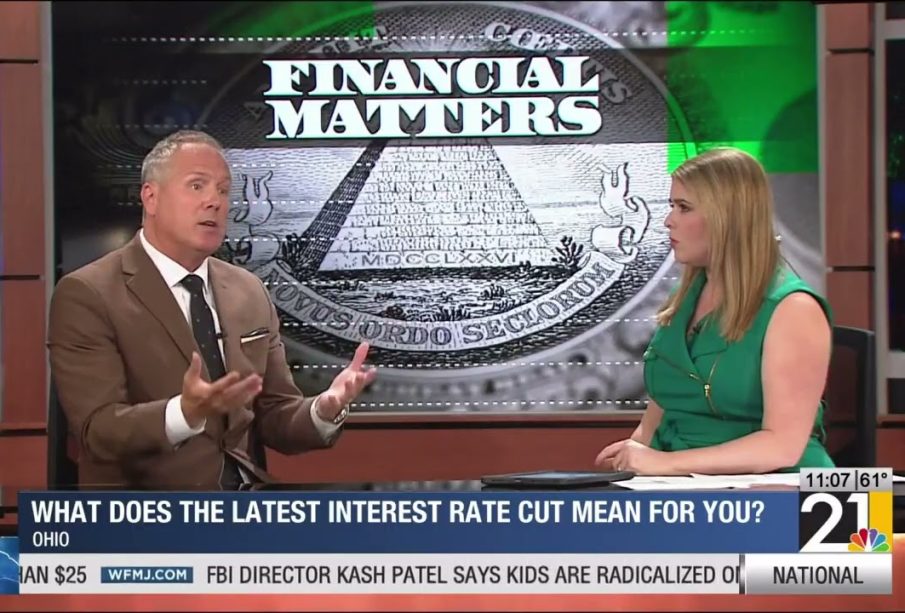

Understanding the Latest Fed Rate Cut News and Its Impact

Introduction to the Importance of Fed Rate Cut News

The recent news surrounding the Federal Reserve’s (Fed) decision to cut interest rates has garnered significant attention from economists, businesses, and consumers alike. With the ongoing challenges posed by inflation and economic uncertainty, the implications of this rate cut are profound, affecting everything from borrowing costs to consumer spending.

Details on Recent Rate Cuts

On March 15, 2023, the Federal Reserve announced a 0.25 percentage point reduction in the federal funds rate, marking the first cut in over a year. This decision was influenced by multiple factors, including slowing economic growth and moderating inflation rates, which have finally shown signs of easing. Fed Chair Jerome Powell indicated that the rate cut aims to support a fragile economic recovery amidst global uncertainties and domestic challenges.

In recent statements following the cut, Powell emphasized the central bank’s commitment to promoting maximum employment and stabilizing prices. Analysts predict that this move will lead to lower borrowing costs for consumers and businesses, fostering increased spending and investment. Bank lending, particularly for mortgages, auto loans, and small business financing, is expected to rise as a result.

Reactions from Economists and Financial Markets

The reaction from economists has been mixed. Some experts argue that the rate cut could stimulate the economy, while others express concern that it may not be sufficient to fully combat the lingering effects of inflation. Financial markets initially rallied in response to the announcement, with stock indices climbing as investors interpreted the cut as a sign of the Fed’s responsiveness to economic conditions.

Significance and Future Outlook

As the economic landscape continues to evolve, the significance of the Fed’s rate cut cannot be understated. It represents a strategic maneuver to encourage economic growth and stability. However, experts warn that ongoing geopolitical tensions and potential future inflationary pressures could challenge the effectiveness of this strategy.

Looking ahead, analysts will closely monitor inflation trends and employment rates to gauge the rate cut’s long-term impact. The Fed’s next steps will depend heavily on data trends, and it will be crucial for consumers and businesses to stay informed about potential future rate adjustments.

Conclusion

The recent Fed rate cut news is pivotal in shaping the economic outlook for both consumers and businesses. Understanding its implications can help individuals make informed financial decisions. The ability to adapt to these changes will play a critical role in navigating the complexities of the current economic environment.