Understanding the KOSPI Index: Performance and Trends

Introduction

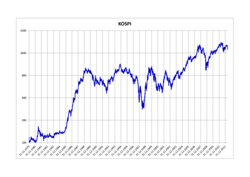

The KOSPI Index, short for Korea Composite Stock Price Index, serves as a critical barometer for South Korea’s stock market performance. It aggregates the values of common stocks traded on the Korea Exchange, making it essential for investors, economists, and analysts to gauge the overall health of Korea’s economy. As global investment interest in the Asian markets has surged, understanding the KOSPI’s current trends and movements becomes increasingly important for decision-making.

Current Trends in the KOSPI Index

As of October 2023, the KOSPI Index has shown remarkable resilience in the face of global economic fluctuations. After experiencing a significant drop earlier in the year due to international market volatility and inflation concerns, the index has gradually regained ground, recently reaching a level of 2,600 points. This recovery has been attributed to positive corporate earnings reports, particularly in technology and automotive sectors, which are vital to South Korea’s economy.

In the latest quarterly report, major companies like Samsung Electronics reported better-than-expected earnings, which provided a boost to investor confidence. Such performances are crucial as they not only impact stock market dynamics but also reflect the underlying economic conditions of the region.

Factors Influencing the KOSPI Index

The KOSPI Index is influenced by a multitude of factors including domestic economic policies, international trade relations, and global market trends. Recent uncertainties surrounding US-China relations and supply chain issues have also played a role in shaping investor sentiment.

Furthermore, interest rate adjustments by the U.S. Federal Reserve have a ripple effect on foreign investments in emerging markets like South Korea. When interest rates rise in the U.S., it often results in higher yields for investors in the U.S., prompting a capital outflow from markets like the KOSPI.

Conclusion

Looking ahead, analysts advise that while positive trends in the KOSPI Index provide a favorable outlook, investors should remain vigilant of global economic conditions and geopolitical factors that may introduce volatility. The index’s performance not only reflects the health of South Korea’s economy but also indicates the broader sentiments affecting investor confidence in Asia. For those involved in trading or investing in this vital market, understanding these dynamics will be essential for navigating future fluctuations.