Understanding the KOSPI Index: A Key Indicator of South Korea’s Economy

Introduction

The KOSPI Index is a crucial barometer for the South Korean economy, representing the performance of the country’s stock market. It serves as an important indicator for investors, policymakers, and economists, reflecting the overall health of corporate performance within South Korea. In recent times, the KOSPI has gained attention not only for its financial insights but also for its role in global market movements, making this topic significant for anyone interested in international economics and investing.

Recent Trends in the KOSPI Index

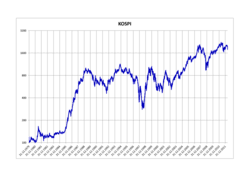

As of late October 2023, the KOSPI index has shown signs of resilience despite global economic uncertainties. Following a period of volatility, attributed to factors such as inflationary pressures and geopolitical tensions, the index rebounded to levels not seen since mid-2022. This resurgence is partially credited to an uptick in technology stock performance, especially companies like Samsung Electronics and SK Hynix, which dominate the index due to their substantial market capitalizations.

In recent trading sessions, the KOSPI has reached approximately 2,500 points, marking a significant recovery from earlier declines that saw it dip below 2,400 points earlier in the year. Analysts attribute this bounce back to a combination of strong quarterly earnings reports and optimism surrounding South Korea’s export sector, particularly in the semiconductor and automobile industries, which are pivotal for the country’s economic growth.

Implications for Investors

The fluctuations of the KOSPI index have substantial implications for both domestic and international investors. A rising KOSPI typically signals economic health and investor confidence, encouraging further investment inflows. Market analysts are optimistic that the index could continue its upward trajectory if global economic conditions stabilize and companies within the index sustain their earnings growth.

Moreover, as many foreign investors consider the KOSPI as an entry point into the Asian markets, changes in the index can influence international perceptions of South Korea’s economic stability. The KOSPI’s performance might be mirrored in the broader Asia-Pacific region, affecting investment strategies across multiple markets.

Conclusion

In summary, the KOSPI index is more than just a number; it is indicative of South Korea’s economic landscape and investor sentiment. As we look ahead, continued monitoring of this index will be crucial for understanding both national and global financial trends. Investors are advised to remain informed about the developed and emerging market conditions that could affect the KOSPI, as its movements often foreshadow larger economic shifts.