Understanding the ITR Filing Last Date for 2025

Importance of Timely ITR Filing

Filing Income Tax Returns (ITR) is a crucial obligation for taxpayers in India. Ensuring that ITR is filed before the deadline helps individuals avoid penalties and interest on late payments. The date set by the Income Tax Department for filing these returns is a vital piece of information for taxpayers, and in 2025, it holds significant relevance due to the potential changes in tax laws and the economic climate.

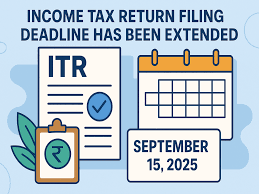

ITR Filing Last Date for 2025

For the financial year 2024-25 (Assessment Year 2025-26), the last date for filing ITR is expected to be July 31, 2025, for individuals and August 31, 2025, for businesses and those required to get their accounts audited. These dates align with the deadline used in previous years, with the government likely to maintain consistency to aid in tax compliance.

Consequences of Late Filing

Filing after the last date can lead to various consequences, including penalties and an increased interest burden on tax dues. For example, taxpayers may be subjected to a late filing fee as prescribed under Section 234F of the Income Tax Act, which can be up to ₹10,000, depending on when the return is filed. Thus, being aware of these deadlines is essential to avoid unnecessary financial repercussions.

Future Considerations and Advice

As 2025 approaches, taxpayers should stay informed about any changes in the tax structure that may affect their filing. It is advisable to maintain meticulous records of income and deductions throughout the year, ensuring preparedness as the deadline looms. Consulting tax professionals can also provide valuable insights and assistance in filing accurately and timely.

Conclusion

In summary, the last date for ITR filing in 2025 will play a critical role in the compliance landscape for individual taxpayers and businesses alike. Awareness and action towards these deadlines can lead to more effective tax planning and financial management. As the last date approaches, taxpayers are urged to prioritize their ITR filings to avoid complications and penalties.