Understanding the ITR Filing Last Date 2025

Importance of ITR Filing in India

Income Tax Return (ITR) filing is a crucial responsibility for taxpayers in India. It helps in maintaining transparency, contributes to the nation’s revenue, and enables taxpayers to claim eligible deductions. Missing the ITR filing deadline can result in penalties and complications for taxpayers, making it essential to stay informed about key dates. As the year 2025 approaches, understanding the ITR filing last date becomes imperative for all.

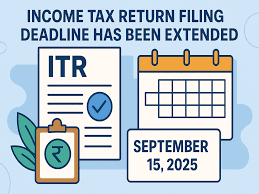

Announced Last Dates for ITR Filing 2025

The Income Tax Department of India typically announces the last dates for filing ITRs well in advance. For the financial year 2024-2025, the due date for filing individual tax returns is expected to be July 31, 2025. However, salaried individuals and those who are filing revisions may have different deadlines. It’s crucial to check the official notifications from the Income Tax Department to stay updated on any changes.

Types of Returns and Their Filing Deadlines

The deadlines for ITR filing may vary depending on the type of income and category of the taxpayer:

- Individual Taxpayers: The last date for individuals with income below the taxable limit is as mentioned earlier (July 31, 2025).

- Companies and Firms: Corporate taxpayers generally have until September 30, 2025, to file their returns.

Possible Consequences of Missing the Deadline

Filing returns after the deadline can lead to various consequences including:

- Payment of penalties, which can range from ₹5,000 to ₹10,000 depending on how late the return is filed.

- Loss of eligibility for carrying forward losses that could offset tax liabilities in future years.

- Complications during loan applications, as many financial institutions require ITR receipts.

Tips for a Smooth ITR Filing Process

To ensure a smooth filing process ahead of the deadline:

- Gather your financial documents early to avoid last-minute scrambles.

- Utilize e-filing platforms for quicker processing and to minimize errors.

- Stay informed about any updates from the Income Tax Department.

Conclusion

As the ITR filing deadline for 2025 approaches, it is essential for taxpayers to prepare in advance. Awareness of the last date, the necessary documentation, and the implications of late filing will help individuals and businesses navigate their tax responsibilities more effectively. Keeping track of these aspects not only aids in compliance but also fosters a culture of timely financial reporting within the society.