Understanding the Income Tax Audit Report Due Date for 2023

Importance of Income Tax Audit Reports

Income tax audit reports play a crucial role in ensuring compliance with tax regulations. They provide a detailed evaluation of a taxpayer’s financial position and help the tax authorities ensure that all income is properly reported and taxes are accurately paid. The due dates for these reports are essential for both taxpayers and auditors to keep track of obligations and avoid penalties.

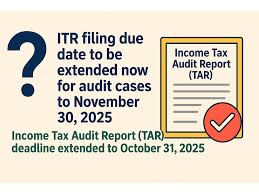

Due Date for Income Tax Audit Reports in 2023

For the financial year ending March 31, 2023, the due date for filing income tax audit reports is set for October 31, 2023. This deadline applies to taxpayers who fall under various audit categories, such as businesses with a turnover exceeding the prescribed limit or professionals with gross receipts beyond a specific threshold. It is imperative that taxpayers prepare their financials well ahead of this date to ensure timely compliance.

Impact of Failure to Meet the Deadline

Failure to submit the income tax audit report by the due date can result in severe consequences for taxpayers. Penalties may be imposed under Section 271B of the Income Tax Act, which can be significant, amounting to a percentage of the total sales or receipts. Additionally, late filings can attract interest under Section 234A, leading to increased financial liabilities for the taxpayer.

Best Practices for Compliance

To ensure compliance with the audit report due date, taxpayers are encouraged to follow a few best practices:

- Early Preparation: Start gathering financial documents and working with your auditor early in the financial year.

- Maintain Transparency: Ensure all income and expenses are accurately reported to prevent discrepancies.

- Consult Professionals: Consider hiring a tax consultant or professional auditor for expert guidance.

Conclusion

Understanding the income tax audit report due date is vital for ensuring compliance with tax regulations. As the deadline of October 31, 2023, approaches, taxpayers should be proactive in their preparations to avoid penalties and ensure a smooth audit process. Staying informed and organized is key to navigating the complexities of income tax regulations.