Understanding the Hang Seng Index and Its Impact

Introduction

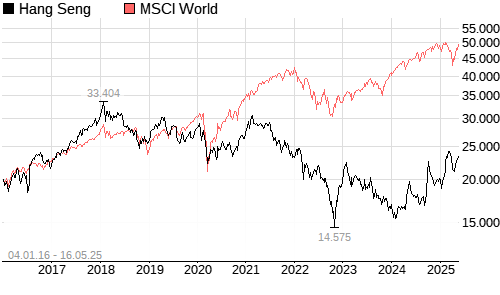

The Hang Seng Index (HSI) serves as a vital indicator of the performance of the Hong Kong stock market. Established in 1969, it comprises 50 of the largest companies listed on the Hong Kong Stock Exchange and is used globally to gauge the health of the Hong Kong economy and financial markets. As economic changes, policy updates, or global events unfold, shifts in the Hang Seng Index can impact investment strategies, making it an essential topic for investors and analysts alike.

Recent Trends and Developments

As of October 2023, the HSI has seen significant fluctuations influenced by various factors including geopolitical tensions, inflation rates, and monetary policies. In recent weeks, the index has experienced a rebound, climbing approximately 10% following a period of downturn attributed to fears surrounding China’s economic recovery and external trade challenges. The HSI closed at around 19,500 points, indicating renewed investor confidence amidst these uncertainties.

Moreover, analysts project that if China’s economy continues to stabilize, with strong domestic consumption and easing of regulatory pressures on major sectors, we may see continued upward momentum in the Hang Seng Index. This trend is supported by positive manufacturing data and government measures aimed at stimulating the economy.

Market Sentiment and Predictions

The performance of the Hang Seng Index is closely watched by both local and international investors. Recent increases in technology stocks, particularly those in e-commerce and fintech sectors, have significantly contributed to the rebound. Companies such as Tencent and Alibaba are critical players, and their performances heavily influence the index’s movements.

Looking ahead, experts remain cautiously optimistic. Factors such as the ongoing U.S.-China trade relations, changes in Federal Reserve policies, and the overall global economic environment will likely shape the future trajectory of the HSI. Moreover, any unforeseen crises, such as health emergencies or geopolitical instability, could impact investor sentiment sharply.

Conclusion

The Hang Seng Index serves as a barometer for both the Hong Kong economy and the broader Asian market landscape. Its movements provide essential insights into investor confidence and economic health. As we progress through the remainder of 2023, the index will be crucial for making investment decisions, revealing not only the immediate effects of regional economic data but also longer-term trends shaped by ongoing global dynamics. For investors, understanding the HSI is not just a matter of tracking numbers; it is about recognizing shifts that could have significant financial implications.