Understanding the Hang Seng Index and Its Global Impact

Introduction

The Hang Seng Index (HSI) is one of the most significant stock market indices in Asia, representing the performance of the Hong Kong stock market. It provides investors with a benchmark for Hong Kong equities and is crucial in understanding market trends in the region. As Hong Kong continues to play a pivotal role in global finance, tracking the changes and movements in the HSI is essential for investors and policymakers alike.

Recent Developments

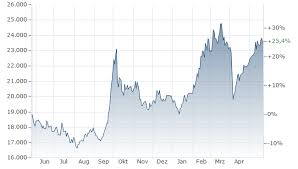

As of October 2023, the Hang Seng Index has been experiencing fluctuations due to various factors including economic adjustments, geopolitical instability, and ongoing global monetary policy changes. Recently, the index witnessed a sharp decline following the announcement of tighter regulations on tech companies by the Chinese government. This move sparked uncertainty among investors, leading to sell-offs in the technology sector, which constitutes a substantial portion of the Hang Seng Index.

Furthermore, analysts have noted the index’s sensitivity to the U.S. Federal Reserve’s decisions, particularly concerning interest rates. In recent months, expectations surrounding potential interest rate hikes have influenced investor sentiment in Hong Kong’s stock markets, prompting volatility in the HSI.

The Significance of HSI

The Hang Seng Index comprises 50 of the largest and most liquid Chinese companies listed on the Hong Kong Stock Exchange. These corporations span various sectors including finance, telecommunications, and consumer goods, thereby providing a comprehensive overview of the Hong Kong economy. Investors globally utilize the HSI as a vital indicator not only of regional economic health but also of broader Asian market trends.

Forecasts and Conclusion

Market analysts predict that the Hang Seng Index may continue to experience fluctuations in the short term due to external economic pressures and local market conditions. However, as the global economy stabilizes, there is optimism that the index will rebound, driven by recovering consumer confidence and potential easing of regulatory pressures on businesses.

For investors, monitoring the Hang Seng Index remains crucial as it reflects critical economic conditions and investment opportunities in Asia. Its performance can significantly influence trade flows and investment strategies, emphasizing its importance in the global economic landscape.