Understanding the EPFO New Withdrawal Rules

Introduction

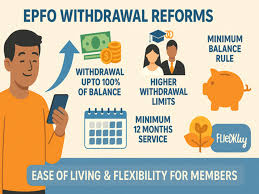

The Employees’ Provident Fund Organisation (EPFO) plays a crucial role in ensuring the financial security of employees in India. With the recent implementation of new withdrawal rules, it is important for subscribers to understand these changes as they could impact their savings and retirement funds. These regulations are designed to streamline the withdrawal process and adapt to the changing needs of the workforce, especially in light of the ongoing economic uncertainties.

Details of the New Withdrawal Rules

As of July 2023, EPFO has introduced several amendments to its withdrawal policies aimed at simplifying the process for subscribers. One significant change allows employees to make partial withdrawals for specific purposes, including medical treatments, home purchase, and higher education. Previously, such withdrawals were often sluggish and heavily regulated, causing distress among subscribers who required quick access to funds.

Under the new guidelines, members can now withdraw up to 75% of their accumulated balance after one month of unemployment, as opposed to the previous stipulation of two months. This adjustment is expected to help individuals manage their finances more effectively during job transitions.

Additionally, members are now permitted to withdraw their EPF balance online using the EPFO portal, which will significantly reduce the paperwork and waiting time involved in the process. The online facility is available for both partial and full withdrawals, making it more convenient for subscribers.

Impact on Subscribers and Future Outlook

The revision of the EPFO withdrawal rules signifies a more flexible approach towards employee retirement funds. Experts believe this will lead to better financial planning for employees, as they can now access funds when they need them most, without unnecessary delays or restrictions.

Looking ahead, it is crucial for subscribers to stay informed about these developments and plan their withdrawals proactively. Awareness campaigns by the EPFO may also emerge to educate members about the new rules and how to navigate the online withdrawal options, ensuring all employees benefit from these changes.

Conclusion

The EPFO’s new withdrawal rules represent a significant shift that aims to empower employees and provide them with greater financial flexibility. By making the process more accessible and user-friendly, the EPFO is responding to the demands of the modern workforce. For subscribers, understanding these changes and utilizing the online services effectively will be key to maximizing their EPF benefits.