Understanding the Dollar Index: Trends and Implications

Introduction

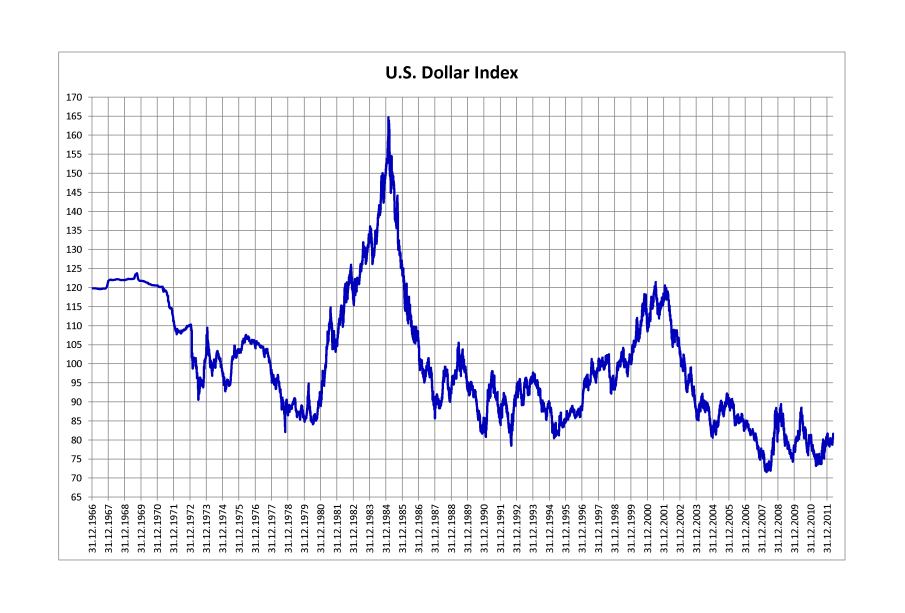

The Dollar Index, a crucial financial metric that measures the value of the United States dollar against a basket of major currencies, plays a significant role in global economic dynamics. It impacts international trade, investment decisions, and economic strategies across the world. In recent months, fluctuations in the Dollar Index have garnered attention, as these variations reflect broader economic trends, inflation concerns, and interest rate shifts.

Current Trends in the Dollar Index

As of October 2023, the Dollar Index has shown considerable volatility, reflecting the U.S. Federal Reserve’s ongoing monetary policy adjustments. Analysts have pointed out that the index rose by approximately 3% over the past quarter, driven by hawkish signals from the Fed concerning interest rates and inflation control measures. This rise can be attributed to investor confidence in the U.S. economy, despite facing challenges such as supply chain disruptions and fluctuating commodity prices.

The strength of the dollar against currencies like the euro, British pound, and Japanese yen has significant implications for global trade. A strong dollar makes U.S. exports more expensive, potentially decreasing their demand in foreign markets. Conversely, it reduces the cost of imports, impacting the trade balance. As the Dollar Index fluctuates, economic policymakers and businesses must navigate these challenges and strategize accordingly.

The Broader Impact of the Dollar Index

The implications of the Dollar Index extend beyond mere currency valuations; they affect global financial markets, investment flows, and commodity prices. A heightened Dollar Index often leads to lower prices for commodities denominated in dollars, such as oil and gold, thereby impacting consumer costs worldwide. For emerging markets, a stronger dollar can lead to increased debt burdens, as many of these nations hold dollar-denominated debt.

Conclusion

The Dollar Index remains a vital indicator of economic health and market sentiment. For investors and analysts, monitoring the index is essential for making informed financial decisions. As we approach the final quarter of 2023, developments in U.S. monetary policy and economic indicators will continue to shape the Dollar Index. Stakeholders must remain vigilant, as the fluctuating dollar can have far-reaching consequences not just for the U.S. economy, but for economic stability and growth worldwide. Understanding these dynamics will be critical for navigating future fiscal landscapes.