Understanding the Dollar Index and Its Market Impact

Introduction

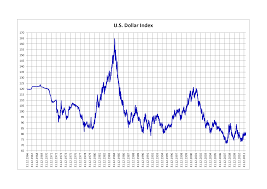

The Dollar Index, also known as the DXY Index, measures the value of the US dollar against a basket of six major currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. This index is crucial for investors, as it reflects the strength of the dollar in global markets and impacts various financial assets, including commodities and stocks. Understanding the trends and movements of the Dollar Index is essential for traders and economic analysts as it serves as a barometer for the USD’s position on the world stage.

Current Trends in the Dollar Index

As of October 2023, the Dollar Index has shown fluctuations due to various economic indicators and geopolitical factors. In recent months, the index registered a significant uptick, with current readings around 105. This rise can be primarily attributed to robust economic data from the United States, including a stronger-than-expected jobs report and inflation figures that suggest the Federal Reserve might maintain higher interest rates for an extended period.

Analysts note that this reinforcement of the dollar’s strength has a direct effect on commodities prices, particularly oil and gold. Generally, a stronger dollar results in lower prices for these commodities as they are priced in dollars. The Fed’s tightening monetary policy is also a critical factor influencing the index, with investors anticipating continued hikes in interest rates to combat inflation.

Global Implications

With the Dollar Index’s current trend, there are considerable implications for emerging markets, where many currencies are pegged to the dollar. A strong dollar can lead to capital outflows from these economies as investments retreat to the safer haven of the dollar. Countries with substantial dollar-denominated debt may also experience added stress as their debt servicing costs increase.

Conclusion

The fluctuations in the Dollar Index are indicative of broader economic conditions, and its current strength reflects a robust US economy but carries risks for global financial stability. Observers forecast that as long as the Federal Reserve remains committed to their inflation targets and interest rate increases, the dollar could maintain its upward momentum. Investor sentiment regarding the dollar will continue to be influenced by federal policies and international economic developments. For traders and market participants, keeping an eye on the Dollar Index is critical, as it can significantly impact investment strategies across various markets.