Understanding the Current USD to INR Exchange Rate

Importance of the USD to INR Exchange Rate

The exchange rate between the US Dollar (USD) and the Indian Rupee (INR) holds significant implications for economic activities, trade, and investments in India. As one of the largest economies globally, fluctuations in the USD to INR exchange rate can influence everything from business contracts to the cost of imports and exports.

Current Trends and Analysis

As of October 2023, the USD to INR exchange rate has shown notable volatility, with rates hovering around 83.00 INR per USD. This fluctuation is primarily attributed to various factors, including US Federal Reserve monetary policy changes, global economic conditions, and India’s inflationary pressures.

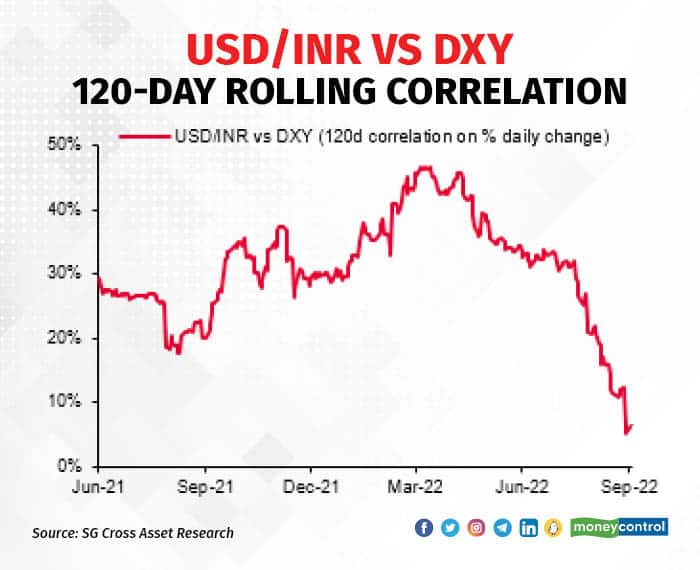

Recently, the Federal Reserve’s hawkish stance on interest rates aimed at curbing inflation has strengthened the USD against major currencies, including the INR. Furthermore, the Reserve Bank of India (RBI) has also been intervening in the forex market to stabilize the Rupee amidst rising oil prices and geopolitical tensions that have led to increased inflation in India.

Impact on the Indian Economy

The rising USD to INR exchange rate impacts various sectors significantly. For businesses that rely on importing goods, a higher exchange rate increases costs, thereby squeezing profit margins and possibly leading to price hikes for consumers. Conversely, exporters may benefit as their products become more competitive in the global market.

In the financial markets, a weaker INR against the USD could deter Foreign Direct Investment (FDI) to some extent, as investors may perceive increased risks. Nonetheless, certain sectors, particularly IT and pharmaceuticals, might also see renewed interest due to their export capabilities.

Conclusion and Future Outlook

Looking ahead, analysts predict that the USD to INR exchange rate will continue to be influenced by global economic indicators and domestic policies. Investors and businesses are advised to keep a close watch on indicators such as inflation rates, the US Federal Reserve’s decisions, and RBI monetary policy to navigate the potential impact on their financial undertakings.

In conclusion, the dynamics of the USD to INR exchange rate not only reflect the economic health of India but also underscore the interconnectedness of global markets. Understanding these trends is crucial for businesses and investors alike as they strategize for an uncertain economic landscape.