Understanding the Current ITC Share Price Trends

Introduction

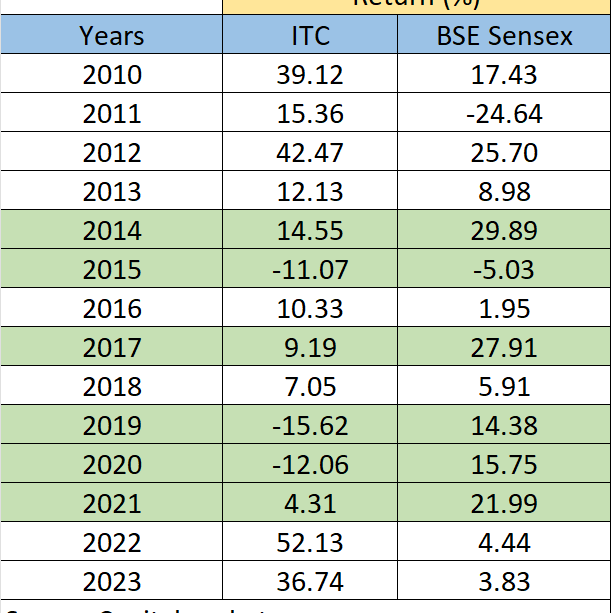

ITC Limited, one of India’s foremost multi-business conglomerates, has been a prominent player in the Indian stock market. The share price of ITC serves as a bellwether for investors, offering insights into the overall market sentiment and the company’s performance. As of October 2023, the ITC share price has garnered significant attention due to various market factors and economic conditions.

Current State of ITC Share Price

As of the latest trading session, ITC’s share price stands at approximately ₹400, showcasing a robust increase of around 12% over the past three months. This upward trajectory can be attributed to several key factors, including the company’s solid financial performance, growth in its FMCG (Fast-Moving Consumer Goods) segment, and overall market recovery post-pandemic.

In its Q2 earnings report, ITC announced a revenue growth of 7%, bolstered by a spike in demand for packaged food and personal care products. Analysts estimate that the steady growth in these sectors will continue to positively impact the share price in the upcoming quarters. Furthermore, the company has been expanding its product portfolio, which is also expected to enhance long-term investor confidence.

Market Influences

The Indian economy is witnessing a gradual recovery, which significantly influences the market trends, including ITC’s stock performance. With the government’s focus on promoting domestic manufacturing and ease of doing business, companies like ITC stand to benefit. The recent decrease in prices of raw materials has also allowed companies to maintain adequate margins, further supporting a favorable valuation for ITC shares.

Analysts remain optimistic about ITC’s future, given its strong fundamentals, competitive market position, and strategic initiatives towards sustainability and innovation. Additionally, the company’s efforts in enhancing its distribution network are expected to contribute positively to its share price.

Conclusion

The outlook for ITC’s share price remains bullish, driven by the company’s consistent performance and strategic growth initiatives. Investors are encouraged to keep an eye on market trends, as fluctuations in the stock market could impact investment decisions. As ITC continues to leverage its strengths, it may well solidify its standing as a preferred choice for investors in the FMCG domain. Regular monitoring of financial reports and market news will be crucial for making informed investment choices regarding ITC shares.