Understanding the Adani Power Stock Split and Its Implications

Importance of the Stock Split

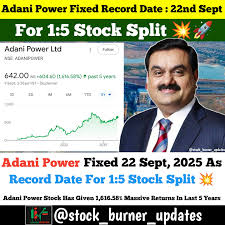

The recent announcement of a stock split by Adani Power Limited has become a significant topic of discussion among investors and analysts. Stock splits are crucial events that can impact stock liquidity, market perception, and investor accessibility. In this case, Adani Power aims to increase the affordability of its shares, thereby attracting a broader investor base.

Details of the Stock Split

On October 1, 2023, Adani Power’s board of directors approved a stock split on a 10:1 basis, meaning that each existing share will be divided into ten shares. This decision was made to enhance the stock’s liquidity on exchanges, allowing for easier buying and selling. The split also aims to make shares more accessible to retail investors who may have found the previous share price prohibitive.

Market Reaction

Following the announcement, shares of Adani Power saw a surge in trading volume, reflecting heightened interest from investors. Historical data indicates that stock splits can lead to increased demand as the lower price per share often entices small investors. Market analysts predict a positive impact on the company’s overall market capitalization and an increase in investor sentiment.

Future Implications

The stock split is expected to take effect on October 15, 2023, subject to regulatory approval. Experts believe that a successful split could signal to potential investors that Adani Power is committed to growth and creating shareholder value. While stock splits do not inherently change the valuation of a company, they often lead to a short-term increase in share prices as investor enthusiasm builds.

Conclusion

In conclusion, the Adani Power stock split is a strategic move aimed at boosting liquidity and accessibility for investors. As the company prepares for this significant corporate action, stakeholders will be closely monitoring the market’s reception. Investors should remain informed about the potential effects of this split, as it could impact their investment strategies and the overall trading dynamics in the Indian power sector.