Understanding Tax Audit Date Extension in 2023

Importance of Tax Audit Date Extensions

In the evolving landscape of taxation, deadlines play a crucial role for both individuals and businesses. Tax audit date extensions, particularly for the fiscal year 2023, are significant as they provide taxpayers additional time to comply with requirements. Given the complexities associated with tax regulations and documentation, extending deadlines can alleviate pressure and ensure accurate filings.

Current Developments

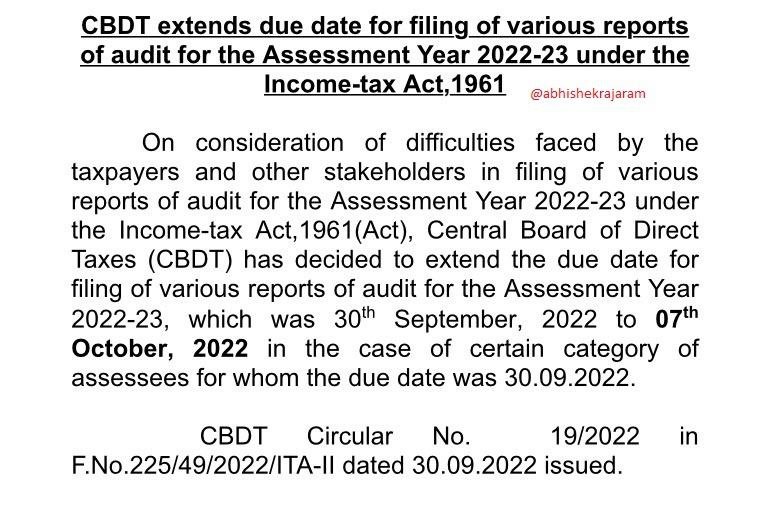

As per recent announcements from the Ministry of Finance, the deadline for tax audits has been extended to December 31, 2023. This decision comes as a relief to a multitude of taxpayers who have faced delays due to various reasons, including the ongoing impacts of the pandemic and complexities in gathering necessary documents. The extension applies to cases where the tax audit is mandatory under Section 44AB of the Income Tax Act for financial year 2022-2023.

Implications for Taxpayers

This extension allows taxpayers to meticulously prepare their audit reports and ensures that financial records are accurately maintained. It also provides an opportunity for businesses to consult with tax professionals to clarify uncertainties about the audit process. Taxpayers are urged to take advantage of this extension for comprehensive preparation, which includes accurately reporting income and expenses, thereby minimizing the risk of mistakes and the potential for penalties.

Conclusion

The extension of the tax audit date is not just a mere relaxation of deadlines, but rather an opportunity for taxpayers to streamline their financial documentation and compliance process. As compliance regulations continue to evolve, it is advisable for individuals and businesses alike to stay informed and proactive in understanding how these changes may affect their financial obligations. The extended deadline could facilitate a smoother tax audit experience, fostering better relationships between taxpayers and tax authorities.