Understanding Silver ETFs and Their Growing Popularity

Introduction

As the global economy navigates uncertainties, more investors are turning to Silver Exchange-Traded Funds (ETFs) as a reliable investment option. Silver ETFs offer an accessible way to invest in silver without the need to physically own the metal. Understanding the dynamics of Silver ETFs is crucial for investors looking to diversify their portfolios and hedge against inflation.

What are Silver ETFs?

Silver ETFs are investment funds that hold silver bullion or silver-related assets. They trade on major exchanges, similar to stocks. Investors can buy shares of the ETF, which represent an ownership stake in the fund’s silver holdings. This structure allows for easier trading and liquidity compared to buying physical silver.

Current Market Overview

As of October 2023, the demand for silver has been on the rise, driven by both industrial usage and investment purposes. Recent trends indicate that many consumers and investors are seeking silver as a refuge amid inflation and economic uncertainty. According to a report by the Silver Institute, global silver demand is expected to exceed 1.1 billion ounces in the coming year, further propelling the growth of silver-backed ETFs.

Benefits of Investing in Silver ETFs

Investing in Silver ETFs provides several advantages:

- Liquidity: Silver ETFs are traded on exchanges, allowing investors to buy or sell shares promptly during market hours.

- Cost-effective: Investors can gain exposure to silver without the costs associated with storing physical metal.

- Diversification: Silver ETFs allow investors to diversify their portfolios by adding precious metals.

Challenges & Risks

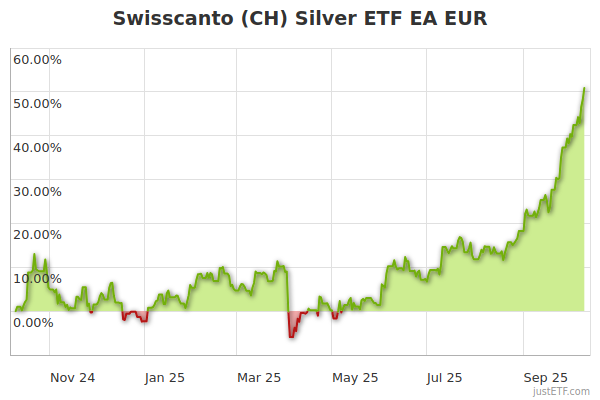

Despite their advantages, there are risks associated with Silver ETFs. Market volatility can affect share prices, and investors may experience significant fluctuations. Additionally, the performance of ETFs is tied to the price of silver, which can be influenced by various factors such as geopolitical events and changes in global demand.

Conclusion

In summary, Silver ETFs present a viable investment opportunity for those looking to diversify and protect against economic uncertainties. As demand for silver continues to grow, it is likely that more investors will consider these funds for their portfolios. However, potential investors should conduct thorough research and consider their risk tolerance before investing in Silver ETFs. Understanding these dynamics will equip readers with the knowledge to make informed decisions about incorporating silver into their investment strategies.