Understanding Sigachi Share Price Trends and Market Impact

Introduction

Sigachi Industries, a prominent player in the microcrystalline cellulose market, has gained significant attention from investors in recent months. Its share price movements have become a focal point for analysts, reflecting broader trends in the pharmaceutical and food industries. Understanding these fluctuations is crucial, not only for potential investors but also for current stakeholders looking to maximize their portfolios.

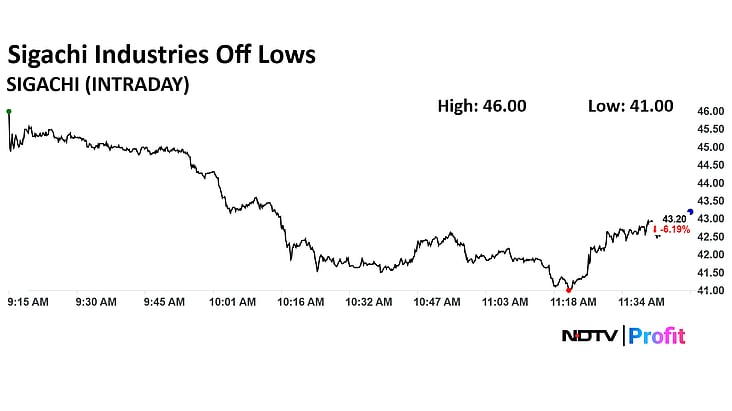

Current Trends in Sigachi Share Price

As of the latest trading session, Sigachi’s share price has experienced notable volatility, trading at approximately ₹312, following a sharp increase of over 6% in the last week alone. The surge is attributed to positive quarterly earnings reports that exceeded market expectations, showcasing a 35% increase in net profit year-on-year. Analysts attribute this growth to the rising demand for microcrystalline cellulose in various sectors, including pharmaceuticals, food, and cosmetics.

Market Response and Analyst Opinions

The stock’s upward trajectory has garnered the attention of several market analysts. Some firms have revised their price targets, projecting a potential increase to ₹350 in the coming months, citing consistent revenue growth and expansion into new markets. However, experts also caution potential investors to consider external factors that may affect share performance, such as global supply chain disruptions and fluctuating raw material costs.

Future Outlook

The outlook for Sigachi’s stock remains optimistic, driven by its strong fundamentals and strategic initiatives. The company is expected to continue its expansion into international markets while enhancing its product portfolio to meet growing consumer demands. Moreover, as more industries recognize the benefits of microcrystalline cellulose, the long-term growth potential remains robust.

Conclusion

The significance of tracking Sigachi’s share price extends beyond mere investment opportunities; it reflects larger trends within the microcrystalline cellulose market and the industries it supports. For investors, staying informed on the latest developments and market forecasts can aid in making strategic decisions that align with their financial goals. As the company navigates its growth trajectory, ongoing analysis will be key in determining the stock’s future performance and investment viability.