Understanding SG Finserve Share Price Trends

Introduction

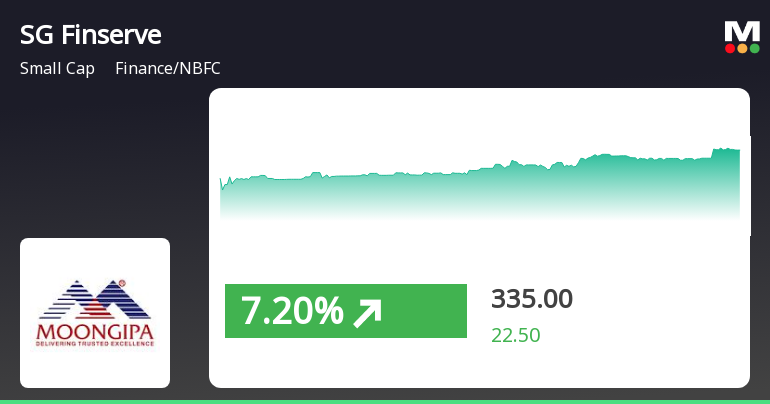

SG Finserve, a prominent player in the financial services sector, has been in the spotlight lately due to fluctuating share prices that impact investors’ portfolios significantly. Share prices are crucial indicators of a company’s market value and financial health, making it essential for investors to stay informed about trends and movements in the financial markets. In this article, we will delve into recent developments regarding SG Finserve’s share price and its implications for investors.

Current Performance and Trends

As of the last trading sessions in October 2023, SG Finserve has witnessed a notable increase in its share price, which has surged by approximately 15% over the past month. This rise can be attributed to several factors, including improved quarterly earnings reports, enhanced operational efficiency, and positive market sentiment around the financial services sector. Analysts have pointed out that the company’s strategic moves towards digital transformation and expanding its service offerings have strengthened investor confidence.

Specific events that have influenced this upward trend include the announcement of a new partnership with a technology firm aimed at upgrading digital infrastructure, which is expected to improve customer experience and operational performance. Moreover, investors reacted positively to news of upcoming regulatory changes that are likely to benefit financial service providers like SG Finserve.

Market Context and Factors Influencing Share Price

The broader market context also plays a critical role in shaping SG Finserve’s share price. The financial services sector is currently experiencing a recovery following a turbulent market phase due to economic uncertainty and changes in monetary policy. The Reserve Bank of India’s recent decisions to maintain interest rates have also contributed to a more stable environment for financial stocks.

Moreover, analysts highlight that the ongoing demand for digital finance solutions has positioned SG Finserve favorably in the market. The company’s concerted effort to innovate and meet changing consumer preferences has resonated well with investors, making them optimistic about its future prospects.

Conclusion

In conclusion, the developments surrounding SG Finserve’s share price reflect broader trends within the financial sector and the company’s strategic responses to market challenges. With a strong emphasis on technology and customer-centric services, SG Finserve is expected to sustain its growth trajectory in the forthcoming quarters. Investors should remain vigilant and continue to monitor both the company’s performance and external market conditions that could influence its share price. Keeping abreast of these factors will be crucial for those looking to engage with SG Finserve’s stock in the evolving financial landscape.