Understanding SBI Bank Share Price: Trends and Analysis

Introduction

The share price of State Bank of India (SBI) is a significant indicator of the bank’s financial health and overall market performance. As one of the largest public sector banks in India, SBI’s stock performance is closely monitored by investors, analysts, and policymakers alike. Any fluctuations in its share price can impact not just the stock market but also the banking sector and the economy as a whole.

Current Trends in SBI Share Price

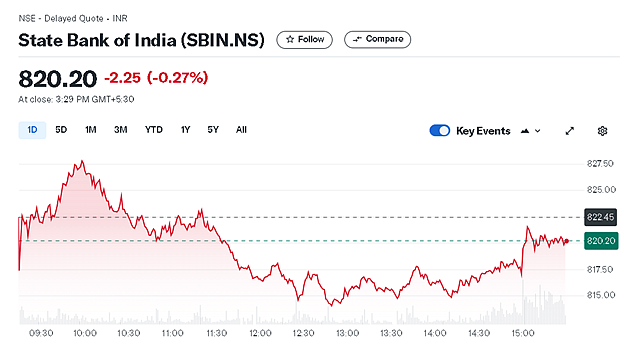

As of the latest reports in October 2023, SBI’s share price has shown considerable fluctuation owing to various market dynamics. The share price recently hovered around ₹700 per share, indicating an upward trend over the past few months. Analysts attribute this rise to strong quarterly earnings reports, improvements in asset quality, and an increase in net interest margins.

Factors Influencing Share Performance

Several factors contribute to the fluctuations in SBI’s share price. These include:

- Quarterly Earnings: SBI reported a significant growth in net profit, which exceeded analysts’ expectations in its last quarterly results, thereby boosting investor confidence.

- Market Sentiment: Global market trends, economic policies, and changes in interest rates also play a crucial role in impacting SBI’s stock price. The recent dovish stance of the Reserve Bank of India has positively influenced banking stocks, including SBI.

- Regulatory Changes: Any regulatory changes which impact lending rates, liquidity, or capital requirements can lead to immediate reactions in share price. For example, the recent initiatives to improve loan disbursement for MSMEs have instilled greater confidence in the banking sector.

Investment Outlook

Experts remain optimistic regarding the future performance of SBI shares amidst a recovering economy and improving credit demand. Some financial analysts project a target price of ₹800-₹850 in the next few quarters assuming stable economic conditions and continued strong performance from the bank.

Conclusion

For investors, monitoring SBI’s share price is essential for making informed investment decisions. As the largest public sector bank in India, its performance can be a bellwether for the banking industry. Keeping an eye on financial results, economic trends, and regulatory changes will continue to be crucial in assessing the future trajectory of SBI’s stock. Given its fundamentals and market position, SBI remains a key player to watch in the Indian financial landscape.