Understanding SBI Bank Share Price Movements

Introduction

The State Bank of India (SBI), India’s largest public sector bank, plays a crucial role in the financial landscape of the country. The performance of SBI’s shares is closely watched by investors, analysts, and financial enthusiasts alike. Understanding the trends and movements in SBI bank share price is essential for both potential investors and market analysts, particularly in light of its influence on the broader financial market.

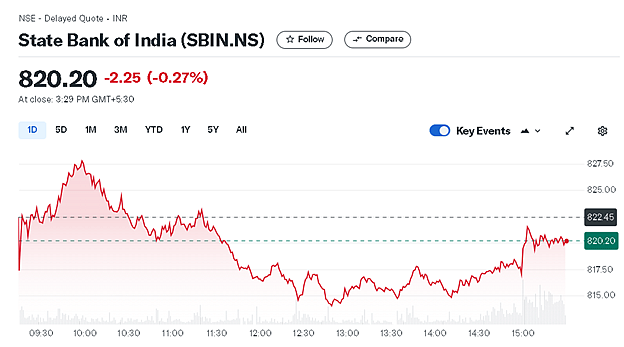

Current Share Price Trends

As of early October 2023, SBI’s share price has experienced significant fluctuations influenced by various economic factors, including changes in interest rates, overall market sentiment, and regulatory developments. Currently, SBI shares are trading around Rs. 620, representing a year-to-date increase of approximately 15%. Analysts attribute this growth to the bank’s robust financial performance in recent quarters, including steady loan growth and improved asset quality.

Factors Influencing Share Price

Several key factors contribute to the variations in SBI’s share price. Firstly, the Reserve Bank of India’s monetary policies have a direct impact on banks’ profitability. Recent hikes in interest rates have enhanced the net interest margins for banks, including SBI, driving investor confidence. Moreover, SBI’s strategic initiatives, such as the expansion of digital banking services and the enhancement of its customer service, have played a significant role in bolstering its market position.

Additionally, external economic conditions, including inflation rates, global market trends, and geopolitical events, also significantly influence the share price. For instance, fluctuations in crude oil prices can impact the Indian economy and, in turn, affect the bank’s performance.

Investor Sentiment and Market Outlook

Investor sentiment surrounding SBI remains cautiously optimistic. Many analysts project that the share price could see further upward movement, especially if the bank continues to post strong quarterly results and maintain its asset quality. However, potential investors are advised to monitor global economic conditions and other market influencers that might impact future earnings.

Conclusion

In conclusion, SBI’s share price remains a topic of interest among investors and market analysts due to its implications for the banking sector and the Indian economy. With ongoing improvements in operational efficiency and a favorable economic environment, SBI is positioned for growth, though caution is warranted due to potential market volatility. Keeping abreast of these developments will help investors make informed decisions regarding their investments in SBI shares.