Understanding Sagility Share Price Movements

Importance of Monitoring Sagility Share Price

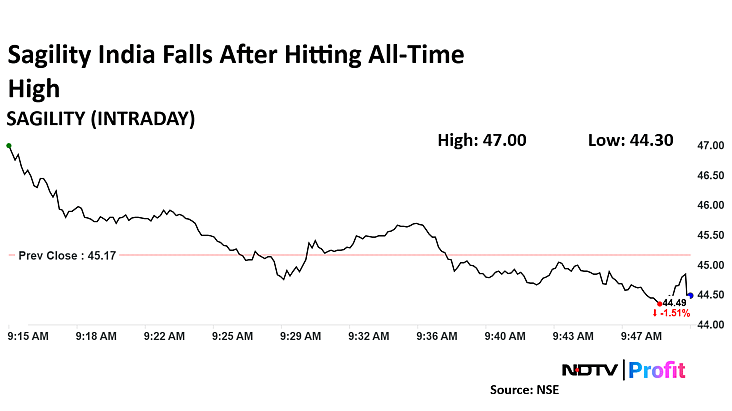

Sagility Holdings Limited, a prominent player in the healthcare services sector, has gained significant attention on stock exchanges recently. Monitoring the Sagility share price is crucial for investors, analysts, and market enthusiasts as it reflects the company’s financial health, market performance, and investor sentiment.

Recent Developments Affecting Share Price

As of October 2023, Sagility’s share price has shown an interesting trend amid fluctuating market conditions. Recent earnings reports indicated a solid growth trajectory, with an increase in revenue of 15% year-on-year, attributed mainly to the expansion of their service offerings in telehealth and digital solutions.

Furthermore, the company recently announced a strategic partnership with a leading health technology firm, expected to enhance their service delivery model. This partnership has likely contributed positively to investor confidence, resulting in a notable uptick in share price following the announcement.

Market Sentiment and Predictions

Analysis from various financial experts suggests that the share price of Sagility could remain volatile in the near term due to external factors like changes in health care regulations and competitive pressures in the tech-driven health service industry. However, many analysts are optimistic about the company’s future performance, with price targets suggesting a growth potential of up to 20% in the coming months.

Conclusion

For investors considering entering or expanding their portfolio in healthcare services, keeping an eye on Sagility’s share price is essential. While current trends show promise, potential investors should conduct thorough research and consult with financial advisors to navigate this dynamic market effectively. The Sagility share price serves as a bellwether for broader trends in the healthcare sector, making it a significant indicator for stakeholders in this rapidly evolving industry.