Understanding RVNL Share Price: Recent Trends and Insights

Introduction

The share price of Rail Vikas Nigam Limited (RVNL) has garnered considerable attention in recent months as investors look for opportunities in the burgeoning infrastructure sector in India. RVNL, a public sector undertaking, plays a crucial role in the development of rail and transportation infrastructure in the country. As the Indian government pushes for increased rail connectivity and modernization, the performance of RVNL shares becomes increasingly relevant for investors.

Current Share Price Performance

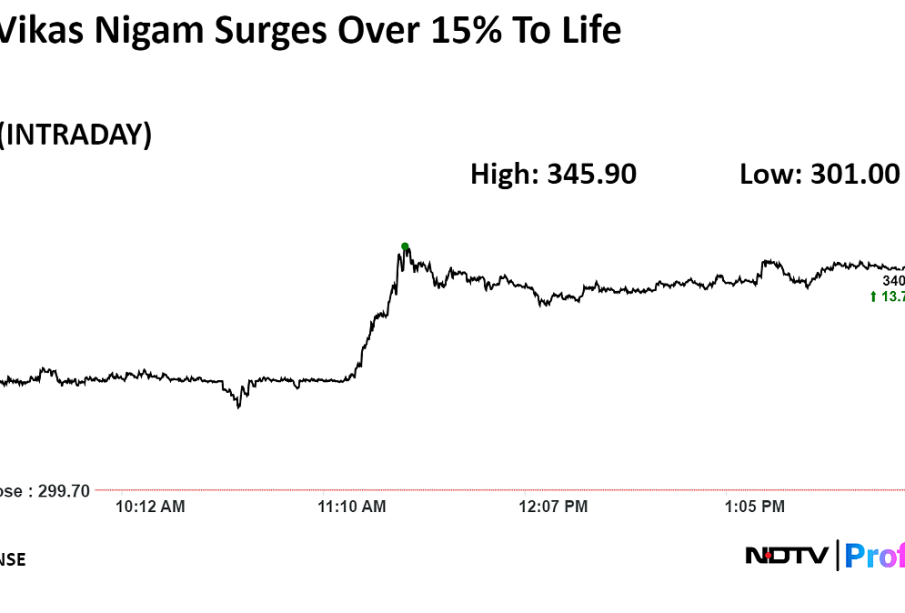

As of October 2023, RVNL shares have shown promising trends amidst the nationwide infrastructure drive. The stock is currently trading at approximately ₹80 per share, experiencing a positive uptick of about 5% over the last month. This rise can be attributed to several key factors, including a surge in government contracts and an increase in spending on railway infrastructure.

Factors Influencing the RVNL Share Price

1. **Government Initiatives**: The Indian government’s push for infrastructure development under the National Infrastructure Pipeline (NIP) has been a significant driver of RVNL’s share price increase. Projects focused on railway electrification, station redevelopment, and suburban rail systems are expected to further enhance the company’s revenue streams.

2. **Market Performance**: Overall stock market sentiment has been favorable, with infrastructure stocks seeing increased investor demand amid economic recovery post-pandemic. RVNL, being a critical player in this space, has benefited from this positive outlook.

3. **Financial Health**: RVNL’s recent financial reports highlighted consistent revenue growth and healthy profit margins, which have instilled confidence among investors. The company reported a quarterly increase in net profit by 20%, underlining its capacity for sustained growth.

Future Outlook

The outlook for RVNL shares remains optimistic due to the ongoing investments by the government in rail infrastructure and potential international collaborations. Analysts believe that the share price may continue to rise as more projects are announced and awarded. However, investors are advised to remain cautious of potential market volatility influenced by global economic conditions.

Conclusion

In conclusion, the RVNL share price reflects the broader trends within India’s infrastructure sector, which is poised for significant growth. As government initiatives continue to unfold, investors interested in RVNL should keep an eye on developments within the company and the regulatory environment. Analysts suggest that long-term investors could consider RVNL shares as part of a diversified portfolio, particularly as the infrastructure sector gains momentum.