Understanding RITES Share Price: Current Trends and Insights

Introduction

RITES Ltd., a public sector enterprise under the Ministry of Railways, plays a crucial role in providing consultancy and project management solutions in the transport sector. As one of India’s leading engineering consultancy firms, monitoring its share price trends offers insights into its operational success and market positioning. The performance of RITES shares is particularly relevant for investors amid recent fluctuations in the stock market influenced by global economic conditions.

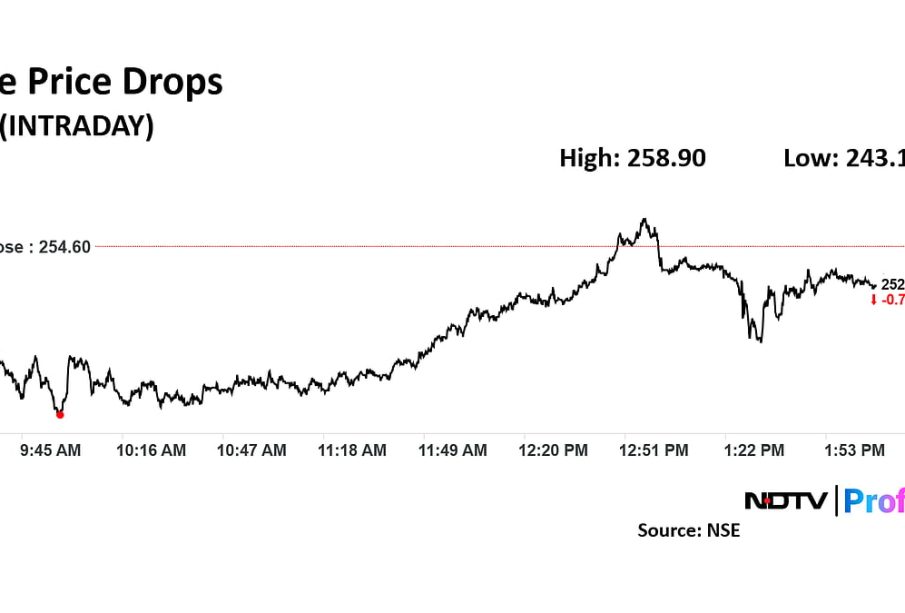

Current Performance of RITES Share Price

As of October 2023, RITES shares have seen notable movements, trading at approximately ₹325.00. This represents a significant increase of around 18% over the past six months. Analysts attribute this growth to several factors, including the company’s strong order book of over ₹500 crores and increased investments in infrastructure projects by the Indian government.

Factors Influencing the Share Price

Several key factors are influencing the RITES share price:

- Government Policies: RITES has benefited from the government’s focus on railway expansion and infrastructure development, which has led to increased demand for consultancy services.

- Financial Performance: RITES reported a substantial increase in net profit in the last quarter, which positively affects investor sentiment.

- Market Sentiment: The overall positive trend in the stock market, driven by global recovery post-pandemic, has enhanced the attractiveness of RITES shares.

Future Outlook for RITES Share Price

Looking ahead, analysts remain optimistic about RITES’ market performance. Given the anticipated infrastructure spending by the government in the upcoming budget, along with RITES’ strong operational capabilities, the share price is expected to remain buoyant. Investors are encouraged to keep an eye on quarterly results and government policy announcements that could impact the company’s order book and financials.

Conclusion

In conclusion, RITES’ current share price reflects its strong market position and the positive impact of government investment in infrastructure. While market conditions remain volatile, RITES presents a promising investment opportunity for those interested in the growing infrastructure sector. Staying informed about economic trends and corporate performance will be key for potential investors looking to make informed decisions.