Understanding Reliance Share Price Trends in 2023

Introduction

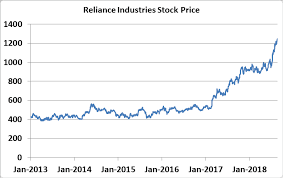

Reliance Industries Limited (RIL) is one of the largest conglomerates in India, and its shares are among the most traded on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Monitoring the Reliance share price is crucial for investors and market analysts as it reflects broader economic trends and investor sentiments. Recent fluctuations in its stock price have attracted significant attention, making it a key focal point in the investment community.

Recent Developments

As of October 2023, Reliance’s share price has experienced notable volatility due to several factors. The company’s strategic ventures, particularly in the digital and retail sectors, have shown promising growth, which initially contributed to a surge in its stock value. In line with rising consumer demand post-pandemic, RIL’s investments in Jio Platforms and its retail business are expected to generate substantial revenue. However, the stock has also faced challenges including rising commodity prices and global economic uncertainties, leading to fluctuations.

On October 2, 2023, RIL shares opened at INR 2,550, marking a slight rise compared to previous weeks. Analysts attribute this increase to the positive response following RIL’s announcement of new projects aimed at expanding its renewable energy portfolio. The company’s commitment to reaching net-zero carbon emissions by 2035 has garnered investor interest and support, reflecting a growing trend towards sustainable investments.

Market Analysts’ Views

Market analysts have diverse opinions regarding the future trajectory of Reliance’s share price. Some foresee a bullish trend, predicting that RIL’s continued expansion into technology and green energy will reinforce its market dominance. Others caution that regulatory challenges and competitive pressures could temper growth prospects in the near term. A recent report by brokerage houses suggests that investors should closely monitor quarterly earnings reports and global market conditions influencing Reliance’s operational sectors.

Conclusion

The Reliance share price is not just a number; it is a reflection of strategic decisions made by a leading player in India’s economy. As RIL continues to innovate and adapt to market conditions, staying informed about changes in its share price is essential for investors. Looking ahead, analysts encourage investors to remain vigilant regarding upcoming announcements related to business operations and market trends, as these will play a pivotal role in shaping the future of Reliance shares.