Understanding Paytm: The Backbone of Digital Payments in India

Introduction

In recent years, digital payment platforms have transformed the way people conduct financial transactions in India. Among these, Paytm stands out as one of the most influential players in the sector. Launched in 2014, Paytm has played a significant role in making digital payments accessible and convenient for millions of Indians. With the rise of e-commerce and the increasing shift towards cashless transactions, understanding Paytm’s journey and its impact on the economy is crucial.

The Evolution of Paytm

Initially starting as a prepaid mobile recharge platform, Paytm has evolved into a comprehensive digital wallet and a full-fledged payment bank. As of now, it offers a plethora of services such as mobile recharges, utility bill payments, ticket bookings, and loan services. According to recent statistics, Paytm boasts over 350 million users and processes millions of transactions daily.

Recent Developments

In recent months, Paytm has been adapting to the rapidly changing digital landscape. In October 2023, the company announced the launch of its new feature that allows users to make international money transfers seamlessly, bolstering its offerings not just for domestic transactions but also for addressing the needs of the Indian diaspora. Furthermore, Paytm has been actively expanding its offline merchant base, enabling small and medium enterprises to accept digital payments easily.

Impact on the Economy

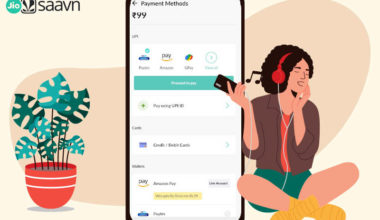

Paytm’s influence extends beyond just being a payment platform. By facilitating digital transactions, it has contributed significantly to India’s goal of becoming a cashless economy. The government has been pushing for a reduction in cash transactions, and platforms like Paytm have been instrumental in this shift. The ease of use along with various cashback offerings has encouraged more users to opt for online transactions. Moreover, Paytm’s integration with the Unified Payments Interface (UPI) system has made transactions faster and more efficient.

Conclusion

As Paytm continues to innovate and expand its services, its significance in the Indian digital payments ecosystem is only set to grow. With a commitment to enhancing user experience and facilitating easy transactions, Paytm is not just a payment platform; it is a vital part of India’s digital future. As more people embrace digital payments, the forecast indicates that Paytm will remain at the forefront, driving financial inclusion and technological advancement in the country.