Understanding Oracle Share Price Trends and Implications

Introduction

The share price of Oracle Corporation, a leading software and cloud computing company, plays a vital role in the technology sector. As one of the largest software companies in the world, its stock performance often reflects broader market trends and investor sentiment towards tech stocks. With the ongoing advancements in cloud services and artificial intelligence, understanding the fluctuation in Oracle’s share price is crucial for investors and analysts alike.

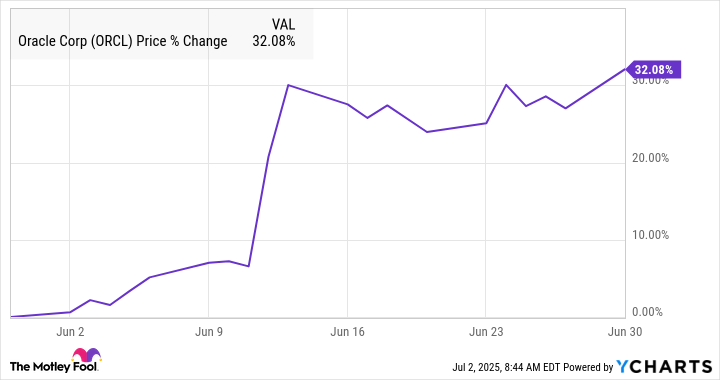

Recent Trends in Oracle Share Price

As of October 2023, Oracle’s share price has shown significant volatility, particularly in light of its recent earnings reports and acquisitions. In September, the company reported a revenue increase of 12% year-over-year, largely driven by its cloud infrastructure services. This announcement led to an immediate jump in its share price, rising by approximately 5% within a week.

However, the stock has also faced downward pressure due to macroeconomic factors such as rising interest rates and concerns about a slowing global economy. In recent trading sessions, Oracle’s share price saw corrections, hovering around $90, as investors reassess their positions. Analysts suggest that while the immediate outlook is mixed, Oracle’s long-term prospects remain positive due to its strong market position and innovative product offerings.

Factors Influencing Oracle’s Share Price

Several factors contribute to the changes in Oracle’s share price, including:

- Earnings Reports: Quarterly performance directly impacts investor confidence.

- Market Conditions: Economic indicators and investor sentiment can cause fluctuations.

- Technological Innovations: New product launches and advancements in cloud technology can drive growth.

- Competitive Landscape: Strong competition from companies like Microsoft and Amazon can affect its market share.

Conclusion

In conclusion, the Oracle share price is a reflection of the company’s performance and market dynamics. While recent trends indicate short-term uncertainty, industry analysts suggest that long-term growth potential remains robust, particularly as Oracle continues to innovate in cloud computing and enterprise software solutions. Investors are encouraged to monitor both macroeconomic indicators and company-specific developments to make informed decisions regarding Oracle’s stock. With the evolving technology landscape, the importance of understanding Oracle’s share price cannot be overstated, as it serves as a barometer for the broader tech sector.