Understanding NSE Pre-Open Market Sessions

Introduction to NSE Pre-Open Sessions

The National Stock Exchange (NSE) of India is crucial for traders and investors looking to gauge market sentiment before the actual trading session begins. The pre-open session is designed to provide a smooth transition into the regular trading hours by allowing market participants to set their buy and sell orders. The importance of the pre-open phase lies in its ability to help establish a fair opening price for securities based on the demand and supply determined during this period.

Details of the Pre-Open Session

The NSE pre-open session typically occurs daily between 9:00 AM and 9:15 AM (IST). This session allows investors to place orders without executing them immediately, leading to price discovery based on the aggregated buy and sell orders. The weighted average price for each security is calculated during this period, which serves as the opening price post the pre-open phase.

During the past few weeks, the significance of the pre-open session has highlighted several key trends. Particularly in September 2023, increased volatility in the markets was observed, alongside burgeoning investor participation. This has been attributed to various factors including corporate earnings announcements, geopolitical developments, and economic data releases that can influence stock prices.

Recent Developments in NSE Pre-Open Sessions

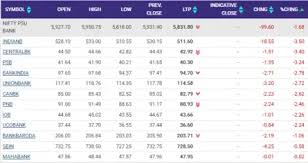

In recent events, on September 29, 2023, the markets showed positive sentiment during the pre-open session despite global headwinds. Major indices such as Nifty 50 and Sensex indicated a slight uptick, reflecting the optimism stemming from favorable economic indicators in manufacturing and service sectors. This pre-open session activity provided valuable insights for investors analyzing market direction.

Conclusion and Forecast

The NSE pre-open session remains an essential tool for investors keen to make informed decisions prior to market openings. With increasing participation, especially amidst a recovering economy, market trends during these sessions can serve as early indicators of broader market behavior. As investors adapt to the rapidly changing economic landscape, closely monitoring pre-open trends will likely aid in achieving better trading outcomes. The pre-open session is pivotal as it not only buffers against drastic market movements but also enhances liquidity in the early trading hours, promising a more stable investment environment.