Understanding NSE Pre Open Market Dynamics

Introduction to NSE Pre Open Market

The National Stock Exchange (NSE) of India plays a crucial role in the financial ecosystem of the country. One of its significant features is the pre-open market session, which is essential for price discovery before the regular trading hours begin. Understanding this session is critical for investors looking to enter or exit positions effectively.

What is the Pre Open Market?

The NSE pre-open market occurs from 9:00 AM to 9:15 AM every trading day. This session aims to reduce volatility and help determine the opening price of stocks based on demand and supply. During this time, investors can place their buy and sell orders, but trades are not executed until the end of the session. The pre-open period is divided into three segments: the first is for order entry, the second is for the matching of orders, and the final segment is for the publication of the opening price.

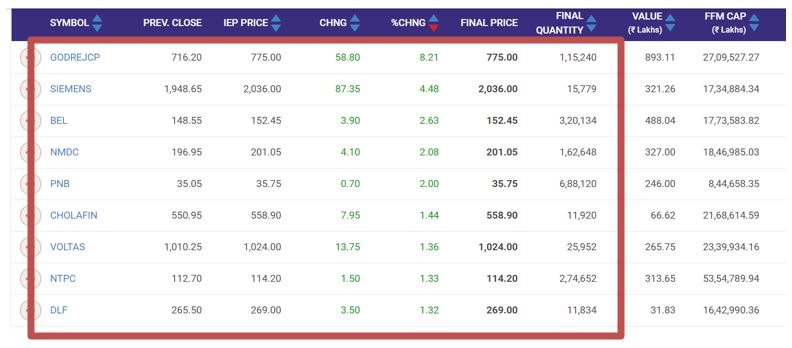

Recent Trends and Performance

As of October 2023, the pre-open market has seen significant activity, particularly as investors assess global economic conditions and domestic factors such as earnings reports and government policies. For example, on October 3, the pre-open session indicated a positive sentiment, with the Nifty and Sensex starting higher, inspired by strong foreign institutional investment inflows. Analysts suggest that frequent fluctuations in international markets have influenced the investors’ behavior, leading to increasing reliance on pre-open trades to gauge market sentiment.

Significance for Investors

The pre-open market session is vital for investors, as it provides an initial snapshot of market trends and can influence trading strategies for the day. For day traders, it offers a chance to identify potential gaps in stock prices that may arise due to overnight news or developments. Additionally, those who are considering long-term investments benefit from observing the market’s initial direction, helping them decide the right entry or exit points.

Conclusion

The NSE pre-open market serves as a crucial component for market participants, allowing them to position themselves effectively before the main trading session begins. With ongoing volatility in global and domestic markets, understanding the nuances of this mechanism becomes vital for investors looking to optimize their trading strategies. As trading technology evolves, the insights garnered during this period could further sharpen investment decisions, enabling investors to navigate the complexities of the stock market more adeptly.