Understanding NPCI and Its Impact on Digital Payments in India

Introduction to NPCI

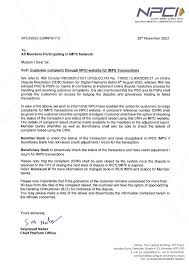

The National Payments Corporation of India (NPCI) has emerged as a pivotal player in transforming the landscape of digital payments in India. Established in 2008, NPCI aims to facilitate a robust payment infrastructure and enhance the efficiency of the payment systems across the country. In an era where digital transactions have surged, NPCI’s role has become increasingly relevant.

Significance of NPCI

NPCI manages various payment systems such as Unified Payments Interface (UPI), National Electronic Funds Transfer (NEFT), and Immediate Payment Service (IMPS), which allow seamless money transfers, bill payments, and the ease of tracking financial transactions. UPI, for instance, has seen exponential growth, reaching over 46 billion transactions in the financial year 2021-2022, signifying a drastic shift in consumer behavior towards cashless transactions.

Recent Developments and Innovations

Recently, NPCI launched multiple initiatives aimed at enhancing user experiences and expanding the reach of digital payments in rural and semi-urban areas. Their latest endeavor, the National Payment Switch System, aims to integrate various payment modes under a single umbrella, ensuring interoperability and accessibility for all. Additionally, NPCI is focusing on technological advancements in digital security to safeguard users against fraud and breaches.

Challenges Faced by NPCI

Despite its successes, NPCI faces challenges in ensuring cyber security, managing the sheer volume of transactions, and building customer trust in digital banking methods. Reports have pointed to numerous phishing scams and security threats, leading to a need for constant vigilance and the implementation of robust security measures.

Conclusion and Future Outlook

As NPCI continues to innovate and expand its services, it is geared toward making digital payments more inclusive and widely adopted across all strata of society. Analysts predict that with the government’s push for a cashless economy, NPCI will further solidify its position as a backbone of India’s financial ecosystem. For readers, understanding NPCI’s functions and updates can greatly enhance their ability to engage safely and effectively in the digital payment landscape.