Understanding Nifty Option Chain and Its Importance in Trading

Introduction to Nifty Option Chain

The Nifty Option Chain is a crucial instrument for traders and investors in the Indian stock market, specifically focusing on the Nifty 50 index. Options trading allows market participants to hedge their positions or speculate on future price movements. Understanding the Nifty Option Chain is vital as it provides insights into market sentiment and the potential volatility of the Nifty index.

What is Nifty Option Chain?

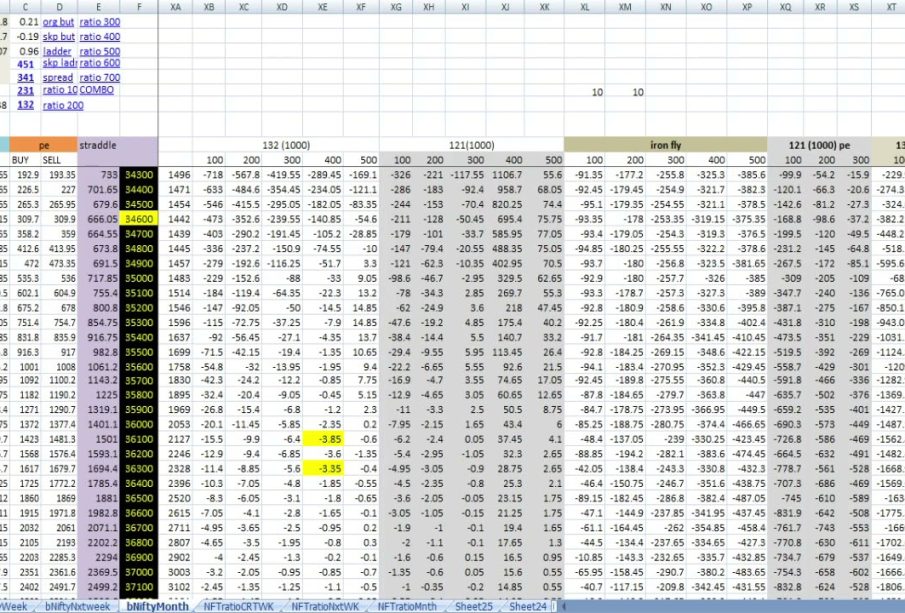

The Nifty Option Chain consists of a list of all the call and put options available for the Nifty 50 index, detailing strike prices, expiry dates, and the premiums associated with these options. It displays buyers and sellers’ interests at various price points, making it an essential tool for traders looking to analyze market conditions. A well-structured option chain allows traders to gauge the strength of the underlying index by reviewing the open interest and volumes.

Importance of Nifty Option Chain

1. Market Sentiment Analysis: The Nifty Option Chain reflects traders’ expectations regarding the future movements of the Nifty index. High open interest in call options indicates bullish sentiment, while high open interest in put options suggests bearish sentiment.

2. Support and Resistance Levels: Option chains help identify critical support and resistance levels based on the concentration of open interest. For instance, if significant open interest is present at a certain strike price, it may act as a psychological barrier for market movements.

3. Strategic Planning: Investors can use the Nifty Option Chain to devise strategies such as straddles, strangles, iron condors, and spreads, tailored specifically to their market outlook and risk appetite.

Current Trends in Nifty Options Trading

As of October 2023, the Nifty Option Chain has shown increased activity, reflecting heightened volatility in the market due to geopolitical tensions and fluctuating global economic indicators. Traders have been closely monitoring changing open interest across various strike prices, which signifies market participants adjusting their positions in anticipation of upcoming events, including earnings reports and economic data releases.

Conclusion

The Nifty Option Chain serves as an indispensable tool for traders in the Indian stock market. By understanding its components and analyzing market data, investors can make informed decisions that align with their trading strategies. As markets continue to evolve, the significance of the Nifty Option Chain will only increase, highlighting the necessity for traders to stay updated on current developments and trends in order to enhance their trading effectiveness.