Understanding NALCO Share Price Movements

Introduction

Essential to investors and industry analysts, the share price of National Aluminium Company Limited (NALCO) reflects the company’s market performance and investor confidence. As a major player in the aluminium sector, fluctuations in NALCO’s share price can indicate broader economic trends, particularly within the minerals and metals domain. Keeping a close eye on NALCO’s stock is vital, especially considering the company’s role in India’s manufacturing and export sectors.

Current Share Price Dynamics

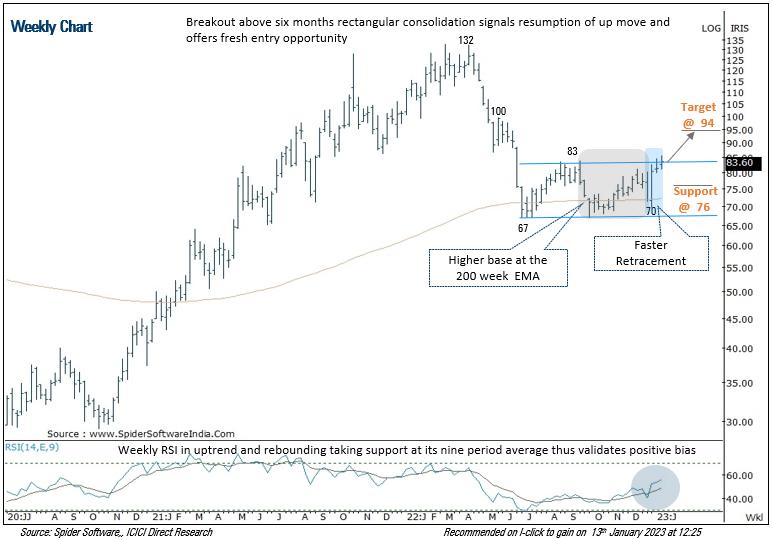

As of October 2023, NALCO’s shares have demonstrated significant movement, closing at approximately ₹85 per share. The stock has experienced fluctuations attributed to global aluminium pricing, changes in import duties, and geopolitical factors that affect trade. Recent reports indicate that the ongoing demand for aluminium in renewable energy projects and electric vehicles may provide a boost to NALCO’s revenue and subsequently its stock price.

Factors Influencing NALCO’s Share Price

Several key factors affect the prices of NALCO shares:

- Global Market Trends: Aluminium prices on the global markets have a direct impact on NALCO’s profitability, which is reflected in its share price.

- Government Policies: Changes in mining regulations and export-import duties influence operational costs and revenue projections.

- Economic Indicators: National GDP growth rates and industrial production levels in India can affect the demand for aluminium, thereby impacting NALCO’s stock performance.

- Quarterly Earnings Reports: When NALCO releases quarterly financial results, significant deviations from investor expectations can cause sharp movements in their share price.

Recent Developments

In recent months, analysts noted NALCO’s strategic investments in developing eco-friendly technologies and enhancing production capabilities. The company’s focus on sustainability may attract environmentally conscious investors, further enhancing its market value. Additionally, NALCO’s participation in government initiatives aimed at boosting local manufacturing is expected to position the company favorably in the eyes of investors.

Conclusion

For current and potential investors, the NALCO share price represents more than a number; it is an indicator of the company’s health and a reflection of the aluminium market dynamics. As aluminium demand fluctuates with the global economy, keeping abreast of market trends and company-specific developments is crucial. Analysts anticipate that NALCO’s share price could stabilize and possibly rise as the impact of renewable projects continues to expand. Staying informed will allow investors to make educated decisions concerning their portfolios.