Understanding Minimum Balance Requirements at ICICI Bank

Importance of Minimum Balance in Banking

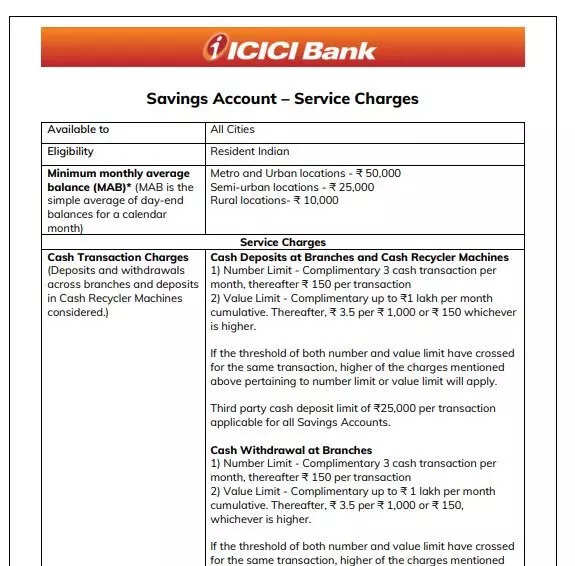

Maintaining a minimum balance in a bank account is crucial for account holders as it often determines the account’s eligibility and service charges. For a leading financial institution like ICICI Bank, these requirements vary based on the type of account, making it essential for customers to be aware of the specifics.

Minimum Balance Requirements

ICICI Bank offers various account types, and each has its own minimum balance stipulation. For instance, for a regular savings account, the minimum balance requirement in urban areas is set at ₹10,000, while in semi-urban and rural areas, it drops to ₹5,000. These balances help ensure account activity and provide the bank with liquidity for lending operations.

Impact of Falling Below Minimum Balance

If an account holder’s balance falls below the prescribed minimum, ICICI Bank charges a penalty, which varies by location and type of account. For urban savings accounts, the penalty can reach up to ₹700 monthly, an amount that could impact a customer’s financial planning. Customers should also consider that falling below the minimum balance requirements may reduce their interest earnings on savings, affecting overall returns.

Customer Reactions and Solutions

With increasing digital transactions and lifestyle changes, many customers find maintaining a high minimum balance challenging. As a result, numerous bank customers have taken to social media to express their frustrations and seek alternatives. In response to customer needs, ICICI Bank has introduced options such as zero-balance accounts, which provide more flexibility for those unable to maintain a high average balance.

Future Trends in Banking

As the banking landscape evolves, ICICI Bank continues to adapt its policies. The trend toward less stringent balance requirements is growing, pushing many banks to re-evaluate their offerings to attract customers. Furthermore, non-traditional banking solutions, including digital wallets and fintech services, are on the rise, potentially influencing changes in minimum balance norms across the industry.

Conclusion

Understanding the minimum balance requirements at ICICI Bank is vital for account holders as it affects financial planning and the overall banking experience. With customer feedback prompting banks to reconsider these policies, a shift toward more inclusive banking solutions may be on the horizon. As consumers, it remains crucial to stay informed about such developments to make responsible and informed banking choices.