Understanding Minimum Balance Requirements at ICICI Bank

Importance of Minimum Balance in Banking

Minimum balance requirements play a crucial role in the banking sector, particularly for account holders at ICICI Bank. Understanding these requirements is essential as it directly affects account maintenance, service fees, and overall banking experience.

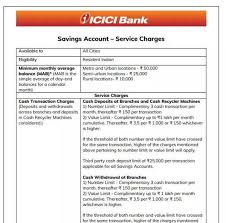

Current Minimum Balance Requirements

As of October 2023, ICICI Bank mandates a minimum balance for its savings accounts that varies based on account type and location. For instance, traditional savings accounts typically require a minimum balance of INR 10,000 in metropolitan areas and INR 5,000 in rural branches. However, ICICI Bank offers several types of accounts, including a Basic Savings Bank Account (BSBDA) which does not require maintaining a minimum balance.

Implications of Not Maintaining Minimum Balance

Failing to maintain the required minimum balance may lead to penalties. ICICI Bank levies a service charge that can range from INR 500 to INR 1000, depending on how far below the minimum your balance is and how many times you fall short in a calendar month. This penalty serves as an incentive for customers to keep their accounts funded and is significant for budget-conscious individuals.

Benefits of Maintaining Minimum Balance

Maintaining the stipulated minimum balance not only helps in avoiding penalties but also enables account holders to take full advantage of various banking services. ICICI Bank provides numerous benefits, including free access to a larger network of ATMs, enhanced interest rates, and preferential treatment on loans and credit products for customers who maintain a good balance in their accounts.

Conclusion

In conclusion, understanding the minimum balance requirements at ICICI Bank is essential for effective financial management. Customers are encouraged to regularly monitor their account balances to avoid penalties and harness the benefits of maintaining higher amounts. With various savings account types to choose from, potential account holders can select an option that best fits their financial habits and lifestyle.