Understanding Mazdock Share Price Trends and Market Impact

Introduction

The Mazdock share price has been a focal point for investors and market analysts alike, especially in the context of the fluctuating economic climate. As one of the prominent players in the shipbuilding industry in India, Mazdock’s stock performance not only reflects the company’s financial health but also indicates broader market trends. Investors are keenly watching Mazdock’s share price for cues regarding potential investments in infrastructure and defense sectors, which are pivotal to India’s growth trajectory.

Current Share Price Dynamics

As of the latest reports, Mazdock’s share price is hovering around ₹300, which marks a significant increase of approximately 15% over the past month. This upward trend can be attributed to several factors, including the government’s increased spending on defense projects and infrastructure development, which directly benefits shipbuilding companies like Mazdock. The company’s recent quarterly earnings also exceeded expectations, showcasing a solid revenue growth of 20% year-over-year, thereby boosting investor confidence.

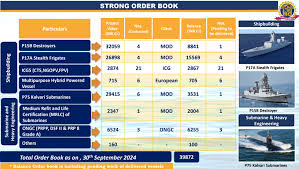

The stock has shown resilience amidst market volatility, partly due to strategic partnerships and contracts secured by Mazdock in recent months. Noteworthy is a new contract with the Indian Navy, which is expected to enhance the company’s order book significantly. Analysts with a focus on maritime industry performance project that Mazdock could maintain this upward momentum, provided they continue to secure substantial government contracts.

Market Insights and Forecasts

Market experts suggest that the continued growth in Mazdock’s share price can be linked to governmental support for the ‘Make in India’ initiative, which aims to bolster local manufacturing capabilities in sectors like defense and maritime infrastructure. As per the latest data released in October 2023, the Indian defense sector is poised to expand at a compounded annual growth rate (CAGR) of 7%, enhancing the demand for locally built naval vessels and related services.

Investors should also consider external factors such as global supply chain issues, fluctuating raw material prices, and the overall performance of financial markets which could impact share prices in the short term. However, the long-term outlook for Mazdock appears promising, with analysts maintaining a ‘buy’ rating on the stock, suggesting an optimistic sentiment for the upcoming quarters.

Conclusion

In conclusion, the Mazdock share price is on an upward trajectory, supported by robust government contracts and market dynamics favoring the defense sector. With increasing investments in infrastructure and defense in India, Mazdock is likely to continue its growth. Investors looking for exposure in the defense manufacturing sector should keep a vigilant eye on Mazdock’s performance as it plays a crucial role in shaping the future of shipbuilding in India.