Understanding Maruti Share Price Trends and Their Significance

Introduction

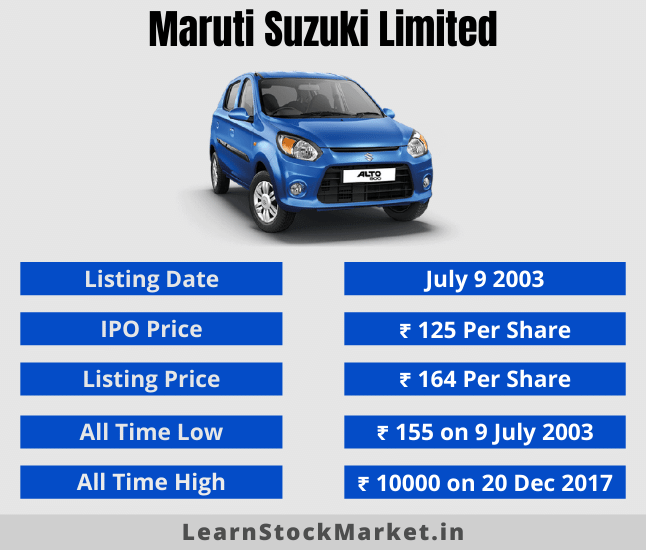

Maruti Suzuki India Limited, a leader in the automobile sector, is a prominent name on the Indian stock market. The performance of its share price often reflects the broader trends within the automotive industry and the Indian economy as a whole. Monitoring Maruti’s share price is crucial for investors, analysts, and enthusiasts alike, as it can influence market sentiments and investment decisions.

Recent Trends in Maruti Share Price

As of October 2023, Maruti’s share price has experienced fluctuations, reflecting various internal and external factors. Recently, the shares have been trading around INR 8,500, a slight increase from previous months, primarily driven by strong quarterly sales results and an optimistic forecast for the festive season. According to the latest data, the company reported a year-on-year increase in vehicle sales by 15%, indicating robust demand.

Major Influencing Factors

Several factors contribute to the movements in Maruti share price:

- Sales Performance: The increase in sales figures, especially during the festive months, has a positive impact on the stock.

- Government Policies: Policies promoting electric vehicles (EVs) and reduced Goods and Services Tax (GST) play a vital role in shaping investor sentiments.

- Supply Chain Dynamics: Recent alleviations in global semiconductor shortages have allowed Maruti to ramp up production, directly influencing its stock.

Investment Outlook

Analysts remain divided on the future trajectory of Maruti’s share price. Some suggest cautious optimism, citing the company’s plans for electric vehicles and expansion in rural markets, which could enhance growth in the coming years. Others warn of external uncertainties, including fluctuating raw material prices and potential global economic downturns, which could weigh on stock performance.

Conclusion

The Maruti share price remains a critical barometer for investors looking to gauge the health of the automotive sector in India. As it stands, current trends appear positive, driven by strong sales and market demand. However, investors should stay abreast of market conditions, government regulations, and the company’s strategic initiatives. As always, informed investment decisions based on comprehensive market analysis will be key to navigating the dynamic landscape of Maruti’s stock performance.