Understanding Lodha Share Price Dynamics and Market Impact

Introduction

Lodha Group, a prominent real estate developer in India, has been making significant waves in the stock market, especially post its recent IPO. As one of the largest residential developers in Mumbai and other key cities, the performance of its shares is crucial for investors and stakeholders. Understanding the fluctuations in the Lodha share price is essential for making informed investment decisions, especially in the current economic landscape.

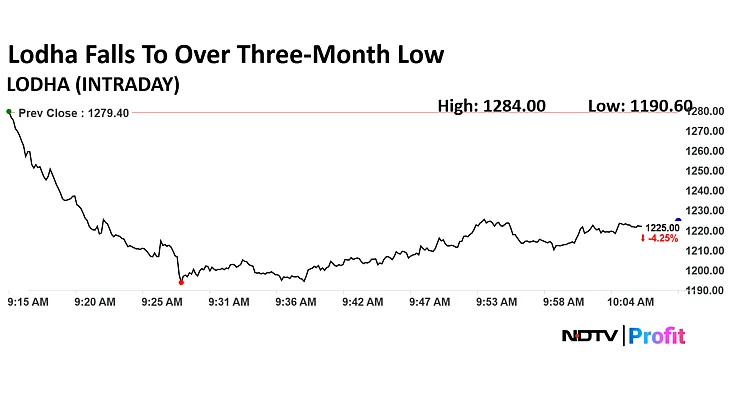

Current Performance of Lodha Share Price

As of October 2023, Lodha share price has seen a series of fluctuations driven by market conditions, investor sentiment, and company announcements. Following its IPO earlier this year, shares were initially priced attractively, resulting in strong demand. However, as the market adjusts, there have been corrections observed. According to data from the Bombay Stock Exchange, the share price has recently settled around ₹525, experiencing a 5% increase in the last week due to favorable quarterly earnings, which significantly outperformed analyst expectations.

Key Factors Influencing the Share Price

Several factors contribute to the current share price of Lodha Group. First and foremost is the real estate market’s recovery post-pandemic, as demand for housing rebounds. Additionally, the announcement of new residential projects and government incentives for affordable housing have positively impacted investor confidence. Market analysts suggest that sustained infrastructure development and increased consumer demand will likely keep the share price stable in the coming months.

However, challenges remain, including rising construction costs and potential regulatory hurdles that could affect profitability. Keeping an eye on interest rates is also crucial, as changes by the Reserve Bank of India could influence borrowing costs and, consequently, housing demand.

Conclusion

In summary, the Lodha share price represents a valuable index of the health of India’s real estate market and investor sentiment. As the company continues to expand and adapt to new market dynamics, stakeholders must remain vigilant. Analysts project that if the company maintains its trajectory of growth and navigates challenges effectively, Lodha Group may offer substantial returns on investment in the medium to long term. Investors are encouraged to monitor news related to housing policies and market trends to leverage opportunities within the Lodha share price framework.