Understanding Laurus Labs Share Price Trends

Introduction

The share price of Laurus Labs, a key player in the pharmaceutical sector, holds significant importance in the financial markets, particularly for investors and stakeholders in India. As a leading manufacturer of APIs (Active Pharmaceutical Ingredients) and formulations, the company has gained attention due to its robust growth trajectory and international collaborations. Understanding the dynamics behind its share price fluctuations can provide valuable insights for prospective investors and market analysts.

Current Market Performance

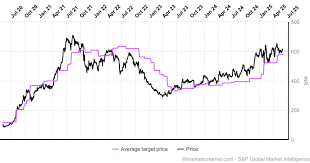

As of October 2023, Laurus Labs’ share price has witnessed a notable increase of approximately 15% over the past three months, reflecting strong quarterly earnings results and renewed investor confidence. On October 10, 2023, the stock was trading at ₹550 per share, having reached an all-time high of ₹580 earlier in the month, driven by positive news surrounding its expansion plans in the U.S. and European markets.

The company recently reported a 20% year-on-year growth in revenue, primarily fueled by increased demand for its anti-retroviral products and other therapeutic categories. This growth has been further supported by strategic partnerships and collaborations with global biotechnology firms, enhancing its market reach and production capabilities.

Factors Influencing Share Price

Several factors contribute to the fluctuations in Laurus Labs’ share price:

- Market Trends: The overall performance of the pharmaceutical sector, particularly in India, influences investor sentiment and share prices.

- Regulatory Developments: Changes in regulatory policies and approvals from agencies such as the FDA can impact production and revenue potential, thus affecting the share price.

- Company Announcements: News related to mergers, acquisitions, or new product launches can lead to significant price movements within a short period.

- Global Economic Factors: Economic conditions, exchange rates, and international trade dynamics can also play a crucial role in shaping the company’s market performance.

Conclusion

The future of Laurus Labs’ share price appears promising as it continues to leverage its strengths in drug manufacturing and international market expansion. With the increasing demand for pharmaceuticals globally, investors may find Laurus Labs an attractive opportunity. However, potential investors should remain vigilant of external factors and remain informed to make well-considered investment decisions. As trends continue to evolve in the ever-changing pharmaceutical landscape, monitoring Laurus Labs’ performance will be key for stakeholders in navigating potential investments.