Understanding KRBL Share Price Trends and Market Impact

Introduction

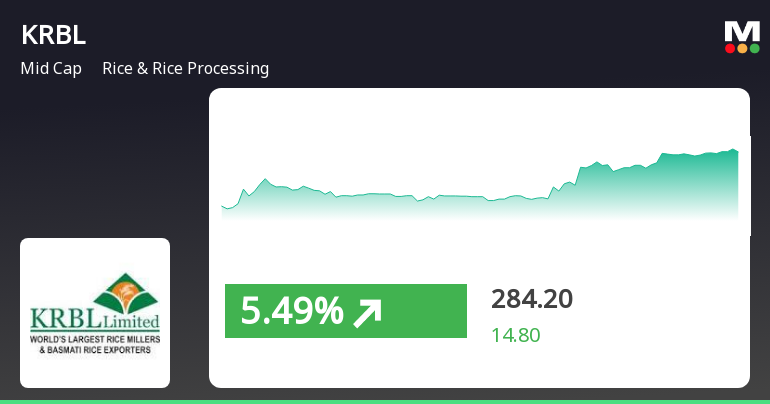

KRBL Limited, one of the leading players in the Indian rice industry, has garnered significant attention in the stock market lately. Understanding the fluctuations in the KRBL share price is essential for investors and stakeholders, as it reflects the company’s performance amid changing market dynamics.

Current Market Performance

As of October 2023, the KRBL share price has experienced notable variations, triggering discussions among investors. Currently trading at approximately INR 240 per share, the stock has shown resilience despite recent challenges in the agricultural sector. Experts attribute this stability to the company’s robust export strategies and diversification efforts, particularly in premium rice products.

Factors Influencing KRBL Share Price

Several factors contribute to the movement of KRBL’s stock price. Firstly, global demand for basmati rice remains high, boosting the company’s revenue. Furthermore, key initiatives such as entering new markets and enhancing production capacity have positively influenced investor confidence.

Additionally, the company’s recent quarterly earnings report indicated a 15% growth in profits, primarily driven by increased exports and efficiency in operations. This performance has been a critical driver of the current share price, fanning hopes for sustained profitability.

Investor Sentiment and Future Outlook

Investor sentiment surrounding KRBL remains optimistic. Analysts predict that if the company maintains its growth trajectory, the share price could see an upward trend, potentially breaking the margins of INR 250 in the coming months. However, challenges such as fluctuating raw material costs and supply chain disruptions could pose risks.

Conclusion

In summary, the KRBL share price stands as a testament to the company’s operational strength and market adaptability. For investors, keeping an eye on these price movements and industry trends is crucial. The long-term outlook appears promising, but stakeholders should remain cautious and informed about the external factors influencing the stock market.