Understanding KOSPI: A Glimpse into South Korea’s Financial Landscape

Introduction

The Korea Composite Stock Price Index, commonly known as KOSPI, is the premier stock market index in South Korea. As a barometer of economic health and investor sentiment, KOSPI plays a critical role in both domestic and international financial markets. Tracking the performance of roughly 800 companies listed on the Korea Exchange, it provides valuable insights into the country’s economic landscape and investor behavior, making it a vital point of interest for financial analysts and global investors alike.

Recent Trends and Performance

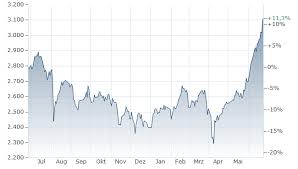

As of October 2023, KOSPI has demonstrated resilience amidst fluctuating global market conditions. The index rebounded from previous lows during the earlier part of the year, reflecting a renewed investor confidence buoyed by improved corporate earnings reports and governmental economic policies aimed at stimulating growth.

After reaching a peak of 2,800 points earlier this month, KOSPI experienced some volatility due to external pressures such as fluctuations in global oil prices and concerns over inflation rates in major economies. Analysts noted that technological stocks, which make up a significant portion of the KOSPI, have driven much of this recovery, particularly with strong performances from companies engaged in semiconductors and electronics.

Impact of Global Events

Global events continue to influence KOSPI’s trajectory. The ongoing tensions between the U.S. and China, along with uncertainties surrounding interest rate hikes from the Federal Reserve, have heightened market volatility. The recent announcements from the Bank of Korea regarding interest rate adjustments have also impacted investor sentiment, leading to cautious trading strategies.

Moreover, geopolitical issues related to North Korea remain a constant risk factor. Analysts point out that stability in the region is crucial for maintaining investor confidence in KOSPI, which often reacts to news related to political tensions. Nevertheless, despite these challenges, many experts believe that KOSPI could reach new highs in the upcoming months if current economic growth trends persist and global market conditions stabilize.

Conclusion

Understanding KOSPI is essential for investors looking to navigate the complexities of the South Korean market. As a dynamic and evolving index, KOSPI not only reflects Korea’s economic standing but also serves as an indicator of broader trends impacting the global economy. With ongoing developments in both local and international contexts, keeping a close eye on KOSPI will be crucial for stakeholders looking to make informed investment decisions. Looking forward, analysts are optimistic about the potential for growth in the index, provided geopolitical tensions ease and economic fundamentals remain strong.