Understanding Kaynes Technology Share Price Dynamics

Introduction

The share price of Kaynes Technology, a prominent player in the electronics manufacturing services sector in India, has garnered significant attention among investors and market analysts. Understanding the trends in its share price is vital not only for current investors but also for potential shareholders looking to enter the market. As a company that has displayed substantial growth post-IPO, its stock movements offer insights into broader industry trends and investor sentiment.

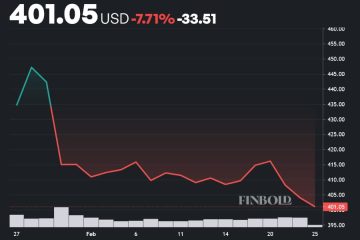

Recent Performance

In the past few months, Kaynes Technology has shown considerable fluctuations in its share price, reflecting both the company’s operational developments and macroeconomic factors affecting the market. Following its IPO in November 2022, where shares were priced at ₹587, the stock initially saw a surge, reaching a high of ₹1,000 in early 2023. However, recent market corrections and increased competition in the technology sector have caused volatility, bringing the share price down to approximately ₹740 as of October 2023.

Factors Influencing Share Price

Several factors contribute to the movements in Kaynes Technology’s share price. Firstly, the company’s financial performance, including quarterly revenue growth and profitability margins, plays a critical role. The recent quarterly results showed a revenue increase of 30% year-on-year, which positively influenced investor confidence.

Additionally, developments such as new client acquisitions, expansion into new markets, and advancements in technology services offered can also impact share prices. The Indian government’s push for manufacturing under the “Make in India” initiative further boosts investor interest in firms like Kaynes Technology, which is positioned to capitalize on local production demands.

Analyst Outlook

Market analysts remain cautiously optimistic about the future of Kaynes Technology. While some forecast that the stock could bounce back and even surpass its previous highs, others urge caution, advising investors to closely monitor developments in the tech sector and the company’s performance metrics. The upcoming earnings call scheduled for mid-November could be a critical moment for investors, offering deeper insights into the company’s future strategy and anticipated revenue streams.

Conclusion

In summary, the share price of Kaynes Technology remains a topic of great interest amid the fluctuating market dynamics. Investors should keep a keen eye on both company-specific announcements and broader market trends to make informed decisions. As the company continues to grow and adapt to industry demands, it will remain a key player in the electronics manufacturing sector, and understanding its share price movements will be essential for stakeholders.