Understanding ITR Filing Due Date Extension for FY 2022-23

Introduction

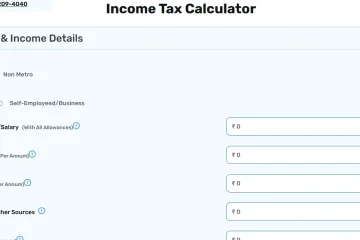

In India, the Income Tax Return (ITR) filing deadline holds significant importance for millions of taxpayers. Typically set for July 31 each year, this date is often modified to accommodate various circumstances, affecting individual taxpayers and businesses alike. The recent extension of the ITR filing deadline for the financial year 2022-23 has caused considerable discussions among taxpayers, financial advisors, and industry stakeholders. Understanding the implications of this extension is crucial for taxpayers to ensure compliance and avoid penalties.

Details of the Extension

The Income Tax Department of India has announced an extension for the ITR filing due date, pushing it from the end of July 2023 to September 30, 2023. This move was made in response to technical glitches experienced by taxpayers during the e-filing process at the original deadline. The government recognized the need for a more inclusive approach, allowing taxpayers additional time to accurately file their returns without the fear of penalties.

Reasons Behind the Announced Extension

Several factors prompted the authorities to extend the ITR filing deadline:

- Technical Issues: Numerous taxpayers faced significant obstacles with the Income Tax e-filing portal, which experienced disruptions and performance inconsistencies.

- Increased Taxpayer Awareness: A surge in taxpayer queries and requests for a deadline extension highlighted the challenges faced by many individuals unfamiliar with the filing process.

- Encouraging Compliance: The additional time is also seen as a strategy to encourage more taxpayers to comply with their filing obligations, reducing the number of late submissions and associated penalties.

Implications for Taxpayers

The extension offers various implications for taxpayers:

- Reduced Stress: Taxpayers now have a more manageable timeframe to gather necessary documents, calculate their taxable income, and ensure accuracy in their ITR.

- Increased Astroloying: The additional time may lead to higher filing numbers, which could impact the tax department’s revenue collection plans, as more individuals may take the opportunity to file accurately.

- Avoiding Penalties: Timely filing can prevent the imposition of late fees and other legal consequences related to non-compliance.

Conclusion

The extension of the ITR filing due date is a significant relief for many taxpayers and presents an opportunity for them to comply with tax regulations without facing undue pressure. Taxpayers are encouraged to take advantage of this extension and ensure they file their returns correctly by the new due date of September 30, 2023. As the digital filing landscape continues to evolve, the government aims to provide a more seamless experience for taxpayers. This extension marks a positive step toward improved taxpayer engagement and compliance.