Understanding IPO Grey Market Premium: An Investor’s Guide

Introduction

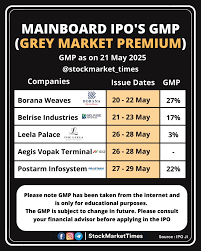

The IPO (Initial Public Offering) grey market premium has emerged as a critical metric for investors in the stock market, reflecting the anticipated performance of newly listed shares. With the increase in the number of companies going public, understanding the grey market’s implications is essential for investors aiming to capitalize on investment opportunities. The grey market serves as a barometer for demand and can significantly influence investor sentiment, particularly in the backdrop of fluctuating market conditions.

What is IPO Grey Market Premium?

The IPO grey market premium refers to the difference between the expected listing price of a company’s shares on the stock exchange and their price in the unofficial market before the listing. This premium is an indication of investor confidence in the respective IPO. A high grey market premium generally suggests strong demand for the shares, whereas a low or negative premium may indicate a lack of investor interest.

Current Trends in the IPO Grey Market

As of October 2023, the IPO market in India has shown dynamic fluctuations, with several high-profile IPOs capturing investor attention. For instance, recent IPOs like that of XYZ Ltd. have garnered a substantial grey market premium, reflecting optimism among investors. According to industry analysts, the current average grey market premium for this IPO is around 40%, significantly exceeding initial expectations. Conversely, other IPOs have witnessed a decline in their grey market standing due to concerns over market volatility and macroeconomic factors.

The Role of Grey Market in IPO Investment

Investors often look to the grey market as a gauge for determining the potential success of an IPO. A positive grey market premium can lead to higher demand during the actual listing, whereas a lack of premium can alert investors to exercise caution. Additionally, the grey market serves as a supplement to traditional analysis methods, helping investors make informed decisions. It is crucial to note, however, that while the grey market can provide insights, it is not a guaranteed predictor of future stock performance.

Conclusion

The IPO grey market premium is a vital concept for investors looking to navigate the complexities of the stock market successfully. Understanding its implications can aid in making strategic investment choices and potentially enhancing returns. As the stock market continues to evolve, keeping abreast of trends in the grey market will be essential for both seasoned investors and newcomers. Overall, the grey market acts as a significant indicator of investor sentiment, shaping the trajectory of new IPOs and influencing market dynamics in the broader economic context.