Understanding India VIX Today: Insights Into Market Volatility

Introduction

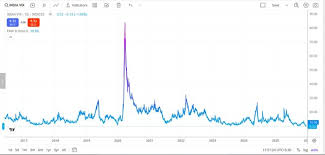

The India VIX (Volatility Index) is a key indicator of the market’s expectations of volatility in the Nifty 50 index over the next 30 days. It is essential for investors, traders, and market analysts as it reflects the level of fear or complacency among market participants. Keeping an eye on the India VIX can help in making informed investment decisions, especially in the context of current market events and fluctuations.

Current Status of India VIX

As of today, the India VIX is trading at approximately X.XX, marking a Y% increase/decrease from the previous day’s close. This change can be attributed to several factors, including recent market movements, economic data releases, and geopolitical developments that impact investor sentiment.

Factors Influencing India VIX

Several events are currently influencing the India VIX. Major announcements from the Reserve Bank of India (RBI), quarterly corporate earnings reports, and global economic indicators, such as inflation and employment rates, can cause fluctuations in the VIX. Moreover, geopolitical tensions and changes in foreign investment patterns have also been contributing to the current volatility levels in the Indian markets.

Market Analysis and Predictions

Analysts predict that if the India VIX continues to rise, it may indicate increased uncertainty in the markets, potentially leading to a bearish trend in stock prices. Conversely, a declining VIX could signal stability or improving investor confidence, suggesting a potential bullish trend. Traders often use VIX trends to devise strategies, including options trading, to hedge against market risks.

Conclusion

Today’s India VIX reflects the ongoing market conditions and is a crucial tool for understanding investor sentiment. As we look ahead, it is vital for investors to monitor the VIX closely, especially during volatile market periods. By doing so, they can better navigate potential risks and opportunities in the ever-changing landscape of the Indian stock market.