Understanding India VIX Today: A Key Indicator of Market Volatility

What is India VIX?

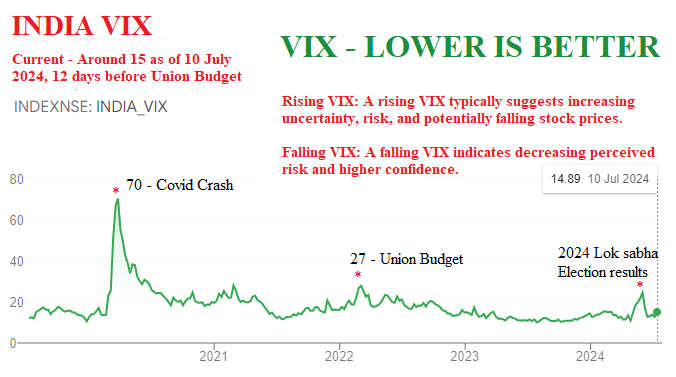

India VIX, often referred to as the Volatility Index, represents the expected market volatility over the next 30 days based on Nifty options pricing. It is a crucial indicator for investors and traders, providing insights into future market movements and investor sentiment. A higher VIX indicates higher volatility and, consequently, higher risk, which could be a signal for caution in the market.

Current Status of India VIX

As of today, the India VIX is trading at approximately 18.50, reflecting a recent increase from the previous trading session. This uptrend signals a considerable rise in market anticipation for volatility, potentially influenced by global market trends and local economic factors such as inflation rates and corporate earnings announcements. The recent fluctuation is attributed to reactions to the ongoing geopolitical tensions, inflation concerns, and the Reserve Bank of India’s monetary policy announcements.

Factors Influencing Today’s India VIX

Several factors are contributing to the current level of the VIX. Firstly, the uncertainty surrounding global oil prices has instigated concerns about inflation, directly impacting market volatility. Additionally, upcoming corporate earnings reports from major companies are inducing nervousness among investors, further elevating the VIX. Lastly, the foreign institutional investment trends indicate decreased buying, creating an atmosphere of caution among local investors.

Implications for Investors

For investors, the current VIX level suggests an increased need for risk management strategies. A rising VIX may recommend a more cautious approach, as markets could experience heightened fluctuations. Traders might consider utilizing options strategies to hedge against potential market downturns or to capitalize on anticipated volatility. It is crucial for investors to remain vigilant, continuously monitoring both domestic and international news that could shape market conditions.

Conclusion

Understanding the India VIX today is vital for navigating the complexities of the stock market environment. With the index showing increased levels of volatility, investors should be proactive in adapting their strategies to manage risks effectively. As market conditions evolve, keeping an eye on India VIX will be essential for making informed investment decisions and staying ahead of the curve.